Warehouse leasing supply to touch almost 60 million sq. ft. by end of 2020

June 12, 2019: The share of e-commerce in overall warehouse leasing uptake went up from 10 percent in 2017 to 23 percent in 2018, according to the findings of the report

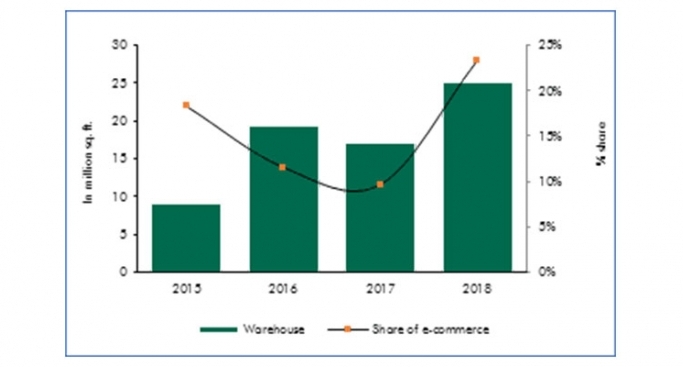

June 12, 2019: The share of e-commerce in overall warehouse leasing uptake went up from 10 percent in 2017 to 23 percent in 2018, according to the findings of the report 'Online retail driving realty – Elevating the e-commerce game' by real estate consulting firm CBRE South Asia Pvt. Ltd. Warehouse leasing crossed the 25 million sq. ft. mark in 2018; grew by more than 45 percent on a year-on-year basis in 2018.

The report examines the link between online retailing (e-tailing) and the logistics sector and the impact of GST on the leasing of warehousing spaces in the country. According to the report, the impressive growth of the e-commerce sector has been propelled by favourable policy reforms, tech-enhanced warehouses, rising smartphone and internet penetration, digital India movement, amongst others.

"The sector has seen unprecedented growth and we expect supply to touch almost 60 million sq. ft. by the end of 2020. Innovative technologies, coupled with viable government reforms such as GST and other global collaborations will further push the envelope of development for the Indian logistics sector and given the dynamics at play, demand and supply are both poised to burgeon in the coming years," said Anshuman Magazine, chairman and CEO, India, South East Asia, Middle East and Africa, CBRE.

The increased demand will witness considerable supply, along with improved quality as large-scale tech-backed logistics facilities are coming up around the country, at par with established global standards. While the overall warehousing supply (grade A and inferior grade) for the sector is expected to be around 60 million sq. ft. till 2020 end, at least 22 million sq. ft. of this supply is estimated to be in the grade A category.

“We anticipate warehouse leasing activity to remain vibrant going forward, driven by continued demand from e-tailers, policy impetus and growing demand from Tier II cities. Modern tech-powered warehouses will rule the roost, pushing inferior grade properties down the demand pyramid. Serious players with a long-term view would also eventually consider ‘green’ logistics networks. As the sector evolves, we can expect to see the addition of more variables to the warehousing equation - supply chain modernisation, growing foray of tech and AI, optimisation of delivery networks and greater synergy between retail and logistics networks,” said Jasmine Singh, national head – industrial & logistics, CBRE.

CBRE predicts the trend of shared fulfilment centres by e-commerce players/retailers for rationalising of costs. The report also mentioned mushrooming of small-scale warehouses, especially in regions close to highly-populated residential catchments. Omnichannel retail will further drive warehouse demand from companies seeking deeper access to more neighbourhoods. Urban distribution networks will need to be optimised for last-mile delivery to enhance delivery speed. There is also likely to be a closer integration of last-mile logistics and bricks-and-mortar retailing as operators strive to improve efficiency. Retail store networks and logistics operations will be viewed as one to ensure that consumer orders are fulfilled in the fastest and the most efficient way.

The report also listed megatrends for the greater digitisation of the logistics sector - increased use of IoT, big data, robotics, automation and over the course of time, blockchain. Physical internet could also be a very real possibility, considering that players are looking at optimising logistics costs over the long-term.