2020 worst year for air cargo demand since monitoring began in 1990: IATA

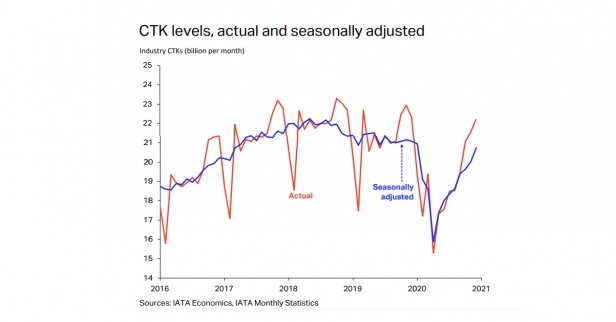

February 4, 2021: The International Air Transport Association (IATA) released data for global air freight markets showing that demand for air cargo decreased by 10.6 percent in 2020, compared to 2019, the largest drop in year-on-year demand since IATA started to monitor cargo performance in 1990, outpacing the 6 percent fall in global trade in good

February 4, 2021: The International Air Transport Association (IATA) released data for global air freight markets showing that demand for air cargo decreased by 10.6 percent in 2020, compared to 2019, the largest drop in year-on-year demand since IATA started to monitor cargo performance in 1990, outpacing the 6 percent fall in global trade in goods.

Global capacity, measured in available cargo tonne-kilometres (ACTKs), shrank by 23.3 percent in 2020 ( 24.1 percent for international operations) compared to 2019. This was more than double the contraction in demand.

Due to the lack of available capacity, cargo load factors rose 7.7 percent in 2020. This contributed to increased yields and revenues, providing support to airlines and some long-haul passenger services in the face of collapsed passenger revenues.

Improvements towards yearend were demonstrated in December when global demand was 0.5 percent below previous-year levels (-2.3 percent for international operations). Global capacity was 17.7 percent below previous-year levels ( 20.6 percent for international operations). That is much deeper than the contraction in demand, indicating the continuing and severe capacity crunch. With the stalling of the recovery in passenger markets, there is no end in sight for the capacity crunch.

Alexandre de Juniac, IATA’s director general and CEO, said, “Air cargo is surviving the crisis in better shape than the passenger side of the business. For many airlines, 2020 saw air cargo become a vital source of revenues, despite weakened demand. But with much of the passenger fleet grounded, meeting demand without belly capacity continues to be an enormous challenge. And, as countries strengthen travel restrictions in the face of new coronavirus variants, it is difficult to see improvements in passenger demand or the capacity crunch. 2021 will be another tough year.”

Asia-Pacific airlines reported a decline in demand of 15.2 percent in 2020 compared to 2019 (-13.2 percent for international operations) and a fall in the capacity of 27.4 percent (-26.2 percent for international operations). In December airlines in the region posted a 3.9 percent decrease in international demand compared to the previous year. After a pause in recovery in Q3, demand is improving, driven by a rebound in manufacturing activity and export orders from China and South Korea. International capacity remained constrained in December, down 25.1 percent.

Middle Eastern carriers reported a decline in demand of 9.5 percent in 2020 compared to 2019 (-9.5 percent for international operations) and a fall in the capacity of 20.9 percent (-20.6 percent for international operations). After a slight slowdown in recovery in November, carriers in the region performed well in December, posting a 2.3 percent increase in international demand. International capacity decreased by 18.2 percent in December, unchanged from November.

2020 was the worst year for #AirCargo demand since IATA began monitoring performance in 1990 due to #COVID19 #Aircargo continues to suffer from a lack of capacity due to the grounding of passenger fleets.https://t.co/aj476Gy09x pic.twitter.com/c1RPOWijg4

— IATA (@IATA) February 3, 2021