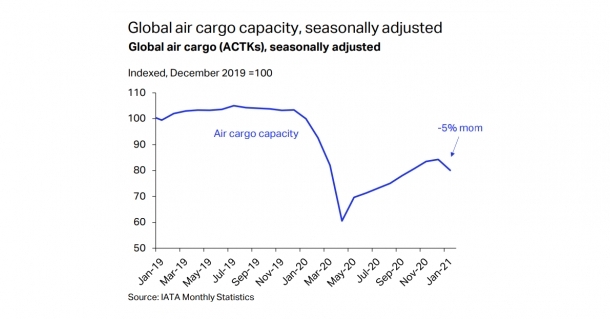

Air cargo capacity in Jan falls 5% MoM, first decline since April 2020

March 5, 2021: The International Air Transport Association (IATA) released January 2021 data for global air cargo markets showing that demand returned to pre-Covid levels (January 2019) for the first time since the crisis while capacity shrank 19.5 percent compared to Jan 2019 and fell 5 percent compared to Dec 2020, the first monthly decline sinc

March 5, 2021: The International Air Transport Association (IATA) released January 2021 data for global air cargo markets showing that demand returned to pre-Covid levels (Jan 2019) for the first time since the crisis while capacity shrank 19.5 percent compared to Jan 2019 and fell 5 percent compared to Dec 2020, the first monthly decline since April 2020 owing to new capacity cuts on the passenger side.

January demand also showed strong month-to-month growth over December 2020 levels.

“Global demand, measured in cargo tonne-kilometres (CTKs), was up 1.1 percent compared to January 2019 and +3 percent compared to December 2020. All regions saw month-on-month improvement in air cargo demand, and North America and Africa were the strongest performers,” said the report.

Conditions in the manufacturing sector remain robust despite new Covid-19 outbreaks that dragged down passenger demand. The global manufacturing Purchasing Managers’ Index (PMI) was at 53.5 in January. Results above 50 indicate manufacturing growth versus the prior month.

The new export orders component of the manufacturing PMI – a leading indicator of air cargo demand– continued to point to further CTK improvement. However, the performance of the metric was less robust compared with Q42020 as Covid-19 resurgence negatively impacted export business in emerging markets. Should this continue or expand to other markers, it could weigh on future air cargo growth.

The level of inventories remains relatively low compared to sales volumes. Historically, this has meant that businesses had to quickly refill their stocks, for which they also used air cargo services.

Alexandre de Juniac, director general and CEO, IATA, said, “Air cargo traffic is back to pre-crisis levels and that is some much-needed good news for the global economy. But while there is a strong demand to ship goods, our ability is capped by the shortage of belly capacity normally provided by passenger aircraft. That should be a sign to governments that they need to share their plans for a restart so that the industry has clarity in terms of how soon more capacity can be brought online. In normal times, a third of world trade by value moves by air. This high-value commerce is vital to helping restore COVID damaged economies—not to mention the critical role air cargo is playing in distributing lifesaving vaccines that must continue for the foreseeable future.”

Asia-Pacific airlines saw demand for international air cargo fall 3.2 percent in January 2021 compared to the same month in 2019. This was an improvement from the 4.0 percent fall in December 2020. International capacity remained constrained in the region, down 27.0 percent versus January 2019, which was a deterioration compared to the 26.2 percent year-over-year decline recorded in December. The region’s airlines reported the highest international load factor at 74.0 percent.