Air cargo loadfactor growth in Sept marks unusual peak season start?

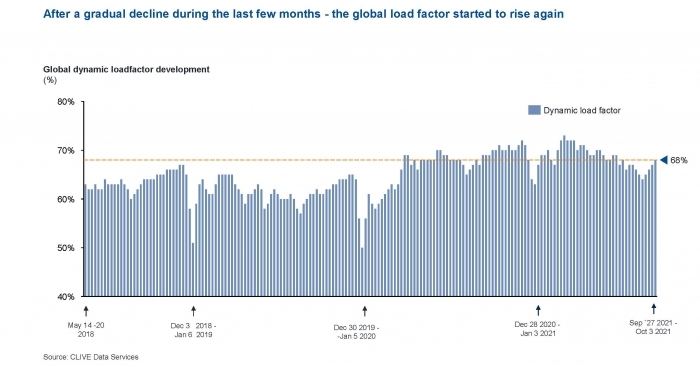

Global air cargo analyst CLIVE Data Services announced that dynamic loadfactor rose to 68 percent in the last week of September, compared to 64 percent four weeks ago, higher than any pre-Covid peak season level since CLIVE began sharing data in May 2018.

October 7, 2021: Global air cargo analyst CLIVE Data Services announced that dynamic loadfactor rose to 68 percent in the last week of September, compared to 64 percent four weeks ago, higher than any pre-Covid peak season level since CLIVE began sharing data in May 2018.

Dynamic loadfactor measures both the volume and weight perspectives of cargo flown and the capacity available to produce a true indicator of airline performance.

“The dynamic loadfactor for September overall remained at 66 percent - but saw a strong upward trend towards the end of the month,” reads the release.

CLIVE’s managing director Niall van de Wouw said, “Many signals and commentaries seem to suggest that this will not be a ‘typical’ peak season. The recent week-over-week increase in loadfactor is a significant jump by any standards and shows the pressure on the air cargo supply chain is clearly further heating up. If airlines are micromanaging their capacity right now, they can benefit from it quite substantially.”

In an interaction with media on Wednesday, Niall informed that he is expecting the dynamic loadfactor to continue climbing in the next weeks due to the expected demand surge in the festive season. However, he reminded that the loadfactor and freight rates increase is not due to the demand going through the roof but the capacity is still short in supply compared to pre-Covid levels.

When asked if he would expect the North Atlantic rates and loadfactor to go down with the introduction of passenger flights, Niall said that even though not in the short term, it will be the first region to slide as the market is made up of predominantly passenger flights.

“Airlines have allocated more space to spot rates than pre-Covid. But there was one airline early this year said that all our capacity commitments out of our three major hubs in Europe are no longer valid. I've not heard that this time around. But I would not be surprised if that would reappear again this year,” Niall said.

He pointed towards the trade imbalances influencing the total loadfactor as Asia westbound outperformed all other routes. In the last week of September (Sept 26 to Oct 3) the average loadfactor from major Asian airports to Europe and the Middle East was 92 percent.

Niall further said, "Europe to North Atlantic market was going through the tipping point. A couple of weeks ago it was 77 percent. It is now up at 82 percent in the last week. And similarly, North Atlantic to Europe was at 51 percent a few weeks ago and is now 60 percent."

"All sorts of indicators notes that the market is further heating up," he added.

Data for September 2021 shows chargeable weight growth of 1 percent vs 2019, on a par with recent months, slowly tapering the gap to September 2020 volumes to +14 percent following the +23 percent and +19 percent levels reported in July and August 2021.

Capacity remained constrained at 13 percent below versus the pre-Covid level seen in September 2019, while in August it was still 16 percent below versus 2019, although this more reflects the reduction in capacity in 2019 because of the ending of the summer season than an increase in capacity in 2021. Compared to August 2021, global air cargo capacity was more-or-less flat on a like-for-like basis month-over-month.

Libin Chacko Kurian

Assistant Editor at STAT Media Group, he has six years of experience in business journalism covering food & beverage, nutraceuticals and now logistics. His current passion is to understand the nuances of global supply chains and their current turmoil. Outside work, he is also interested in philosophy, history, birding and travelling. Mail him: libin@statmediagroup.com Follow on LinkedIn