How is the Indian air cargo sector flying to new heights?

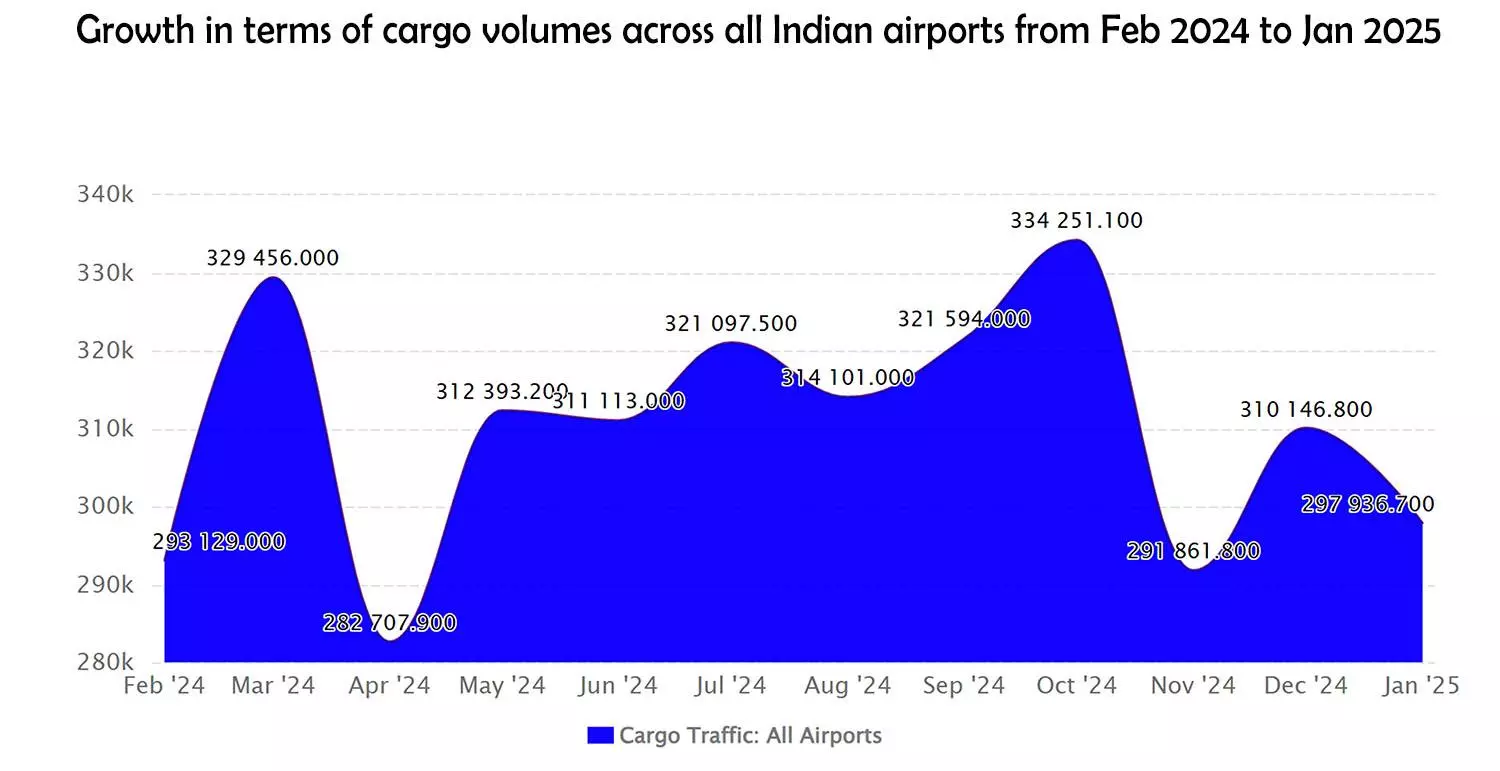

India’s air cargo hits 195,000 tonnes per month, up 13% from 2019, signalling a structural shift in global trade dynamics.

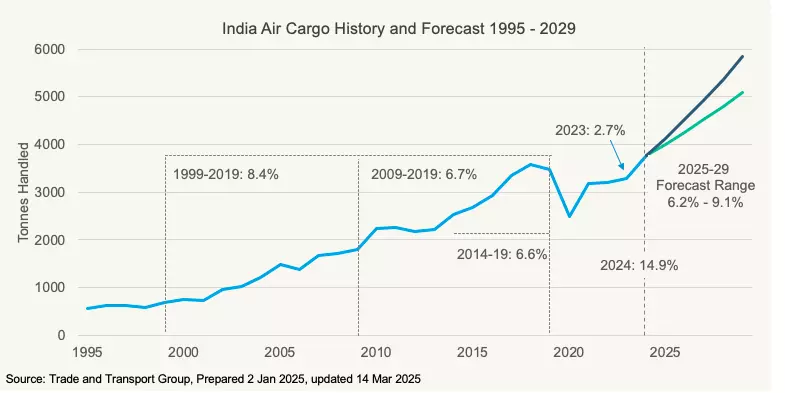

Once overshadowed by the booming passenger aviation sector, India’s air freight industry is now charting a dynamic growth trajectory of its own. Over the past five years, the country’s cargo sector has emerged from the shadows of pandemic-induced disruption to become a key pillar of national and international trade, adapting rapidly to shifts in global demand, export composition, and supply chain strategies.

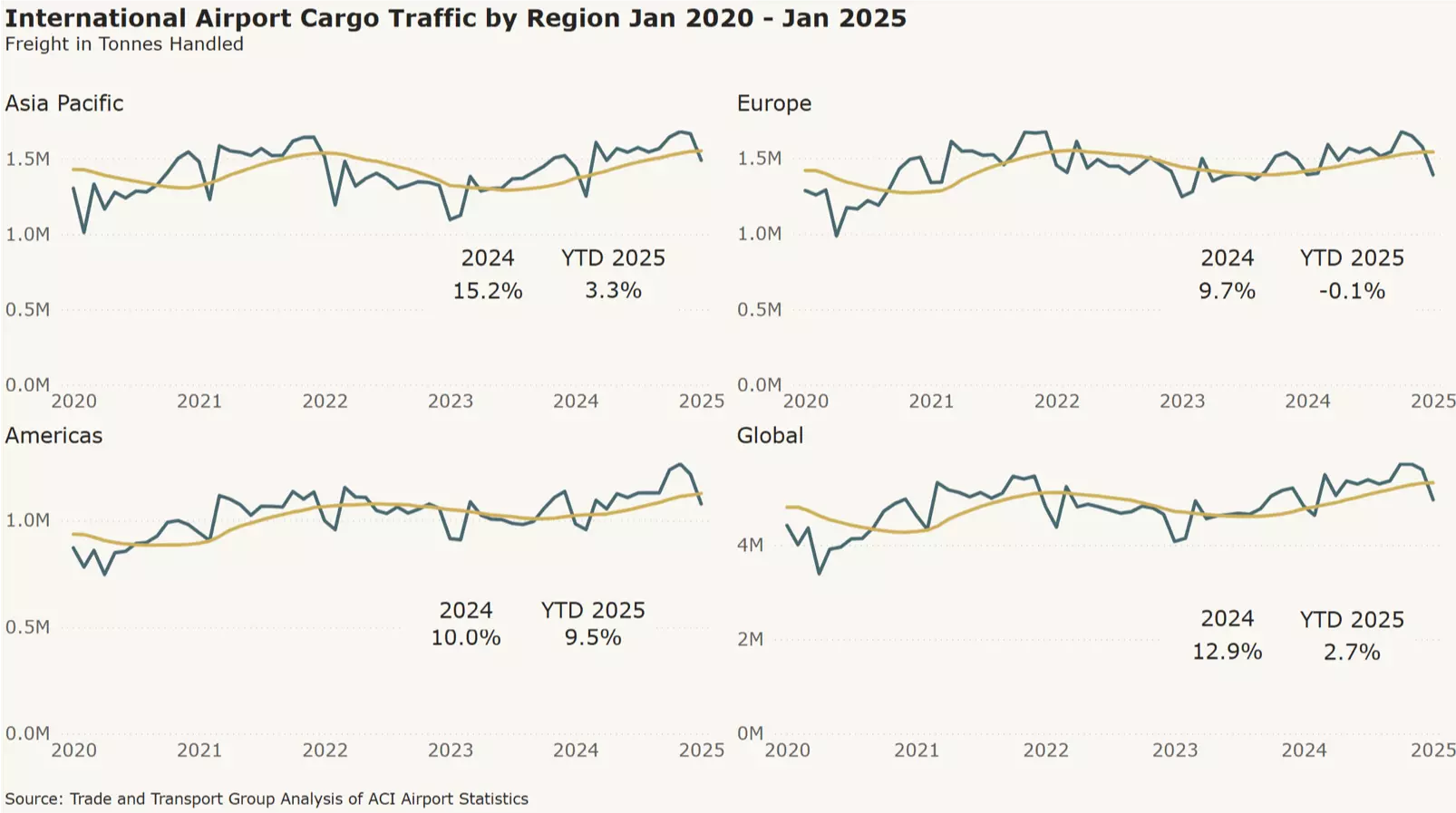

While much of the initial growth post-Covid was about regaining lost ground, the momentum has since evolved into a broader, more structural shift. As Managing Director of Trade and Transport Group, Frederic Horst explains, “A lot of the growth we have been seeing in the last couple of years has only put us back to where we were pre-2020. However, currently, the Indian international air cargo market is running at about 195,000 tonnes per month, which is about 13% higher than in 2019.”

“Currently, the Indian international air cargo market is running at about 195,000 tonnes per month – which is about 13% higher than 2019.”

Frederic Horst, Trade and Transport Group

Recent data from the Airport Authority of India (AAI) underscores this trend. In January 2025, Indian airports handled 184,273.8 tonnes of international freight—a 7.1% increase over January 2024’s 171,988.6 tonnes. Over the ten-month period from April 2024 to January 2025, the total international cargo handled reached 1,928,671.9 tonnes, marking a 17.2% surge compared to 1,645,574.1 tonnes during the same period the previous year.

On the domestic front, cargo volumes are also growing steadily. Domestic freight handled in January 2025 reached 113,662.9 tonnes, up 6.9% from 106,354.1 tonnes in January 2024. Between April 2024 and January 2025, domestic cargo stood at 1,168,600 tonnes, a 6.5% increase over 1,097,516.1 tonnes during the same period the year before.

This recovery—and now expansion—is fuelled by multiple factors: the rise of high-value manufacturing in India, stronger trade ties with North America and Europe, and significant investments in airport infrastructure and cargo handling capacity. The result is a more diversified and resilient air freight ecosystem, better equipped to meet the needs of both domestic exporters and international buyers.

Kuehne+Nagel, which handles 47% of its total shipments via air freight in India, has seen this transformation firsthand. “We’ve witnessed consistent growth in our air freight volumes over the past few years, driven by the rapid expansion of manufacturing, and increasing demand for time-sensitive shipments in sectors like healthcare, high-tech, and perishables,” says Deepak Kumar, National Air Logistics Manager, Kuehne+Nagel India, Sri Lanka, and the Maldives. “With India’s growing role in global trade, we’re well-positioned to capitalise on emerging opportunities in the air freight sector.”

Key hubs powering the growth

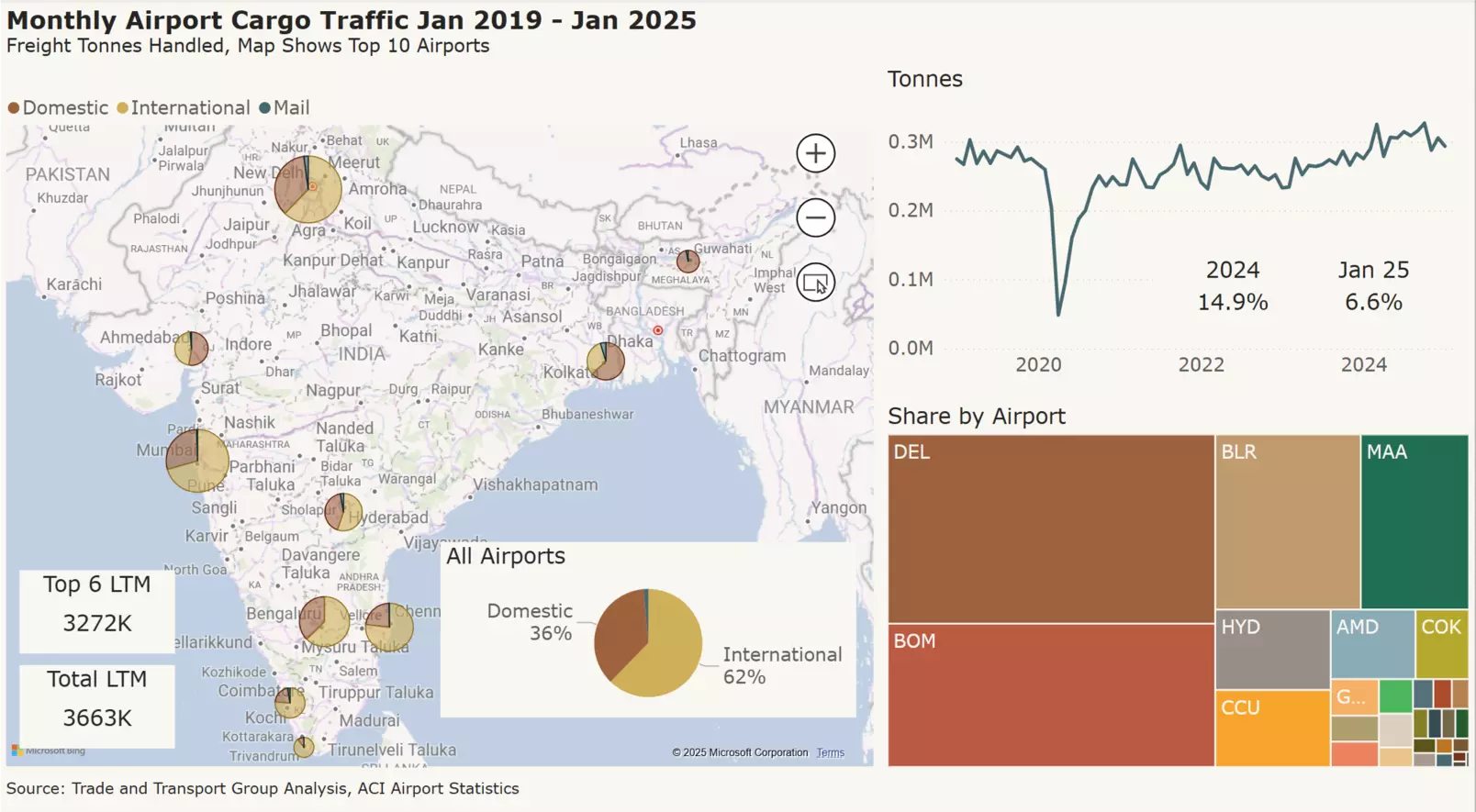

India’s air cargo sector is flying high. In the past year, Indian airports collectively handled 3.66 million tonnes of cargo, with international freight accounting for 62% of the total volume. Four major airports—Delhi, Mumbai, Bangalore, and Chennai—continued to dominate, contributing nearly 75% of all cargo movement.

“We’ve witnessed consistent growth in our air freight volumes over the past few years, driven by the rapid expansion of manufacturing, and increasing demand for time-sensitive shipments in sectors like healthcare, high-tech, and perishables.”

Deepak Kumar, Kuehne+Nagel

Among the key trends, the Dimerco Asia Pacific March 2025 report notes that “air freight capacity and rates for March are expected to increase due to the financial year-end in India,” pointing to continued momentum and seasonal pressure on logistics networks.

Among the top players, Delhi Airport remained the country’s largest cargo hub, handling 609,419.9 tonnes of international freight from April 2024 to January 2025, a 17.7% increase over the same period last year. In January 2025 alone, Delhi processed 59,669.0 tonnes, up 9.3% year-on-year.

Bangalore’s Kempegowda International Airport stood out for its high growth rate, found the AAI report. The airport handled 265,474.5 tonnes during the April–January window, up 23.7% year-on-year. Its January 2025 volumes hit 25,133.0 tonnes, reflecting a 14.3% increase from January 2024.

Mumbai Airport processed 543,596.4 tonnes (+14.0%) in the April–January period, with 51,667.7 tonnes moved in January alone (+3.3%). Chennai Airport handled 241,752.0 tonnes, marking a 15.3% annual rise, with a steady 3.1% bump in January.

A new wave of decentralisation is evident as smaller airports post dramatic growth:

- Coimbatore nearly doubled its international freight, rising 99.8% year-on-year.

- Amritsar surged 77.8%, and Jaipur jumped 53.5%.

In contrast, Jamnagar and Goa Dabolim Airport recorded declines of 69.2% and 53.1%, respectively. However, the latter’s drop is offset by the new Goa Mopa Airport, which ramped up from 724.8 tonnes to 2,200.4 tonnes—a threefold increase, signaling a shift in regional cargo handling.

“BLR Airport has a cargo handling capacity of approximately 715,000 metric tonnes and has seen steady growth, driven by strong export demand and domestic logistics.”

Satyaki Raghunath, BIAL

While international cargo boomed, domestic freight told a more tempered story. India handled 1.17 million tonnes of domestic cargo from April 2024 to January 2025—up 6.5% from the previous year.

- Delhi led again with 315,990.8 tonnes, marking a 6.4% increase. Its January volume rose 15.2%, the strongest monthly performance among metros.

- Mumbai saw modest growth (+2.9%) over the 10-month period but a 2.5% decline in January 2025.

- Bangalore grew 6.2% year-on-year, though it dipped 1.5% in January.

- Chennai reported marginal growth—1.1% over the April–January period and just 1.6% in January.

Among regional airports, only Imphal Airport posted significant growth, with domestic cargo volumes rising 59.5%—highlighting the increasing role of the Northeast in India’s air logistics network.

Talking about Bangalore Airport’s handling capacity and overall operations, Satyaki Raghunath, COO of BIALmentioned, “BLR Airport has a cargo handling capacity of approximately 715,000 metric tonnes and has seen steady growth, driven by strong export demand and domestic logistics.”. In CY 2024, BLR processed 496,227 metric tonnes of cargo—a 17% year-on-year increase — bolstered by a 23% rise in international volumes.

This growth reflects a shifting commodity mix. “The cargo landscape has evolved significantly, with agri-perishables, garments, pharmaceuticals, machinery parts, and e-commerce leading the surge,” Raghunath notes. In FY 2023–24 alone, BLR handled over 63,000 metric tonnes of perishable cargo, representing a significant share of both national and southern India’s perishable air freight.

BLR’s global connectivity spans 12 freighter airlines and key routes like Singapore, Frankfurt, and Chicago on the export side, and Shenzhen, Hong Kong, and Frankfurt for imports — handling everything from perishables and fashion to high-value electronics and industrial parts. Its infrastructure is geared for flexibility and resilience, with a dedicated express cargo terminal, a new domestic cargo terminal tailored to e-commerce volumes, and the advanced Coolport facility supporting over 40,000 tonnes of temperature-sensitive cargo annually.

Adding to this strength is WFS India’s presence at BLR. “Our Coolport terminal is built with over 20 specialised cold rooms and IoT-enabled tracking for real-time control,” says Manish Agnihotri, CEO of WFS India. “We’ve also implemented a cloud-based warehouse system that integrates with airlines and customs to streamline operations.”

To support future demand, BIAL is expanding its cold chain capacity to 80,000 tonnes, revamping cargo terminals, and developing a new logistics park—part of its ambition to surpass one million tonnes in annual cargo throughput by the early 2030s. “Our investments in automation, cold-chain logistics, and sustainability are strengthening BLR’s role as a key air cargo hub,” Raghunath adds.

“Air freight accounts for about 40% of our total shipments — primarily for sectors like pharma, healthcare, retail, and auto.”

Malcolm D’Souza, Jeena & Company

This growth is also mirrored in other major hubs like Delhi and Hyderabad. These air cargo hubs have exceeded pre-Covid cargo levels, thanks to similar infrastructure improvements, digitisation and diversified export portfolios.

Logistics providers are adapting quickly. “We collaborate with key airports including Mumbai, Delhi, Bangalore, Hyderabad and Chennai to ensure reliability, capacity and seamless service delivery,” says Deepak Kumar of Kuehne+Nagel. “Our focus is on strong, innovative partnerships that align with customer expectations.”

Malcolm D’Souza, Director of Air Freight at Jeena & Company, further adds, “We have a presence in 27+ locations across India, with major air cargo routes connecting key metros such as Mumbai, Delhi, Bangalore, and Chennai. These routes serve as vital trade corridors, ensuring the swift movement of time-sensitive and high-value shipments.” He highlights the unique strengths of each city: “Mumbai and Delhi serve as major international gateways with high-volume traffic. Bangalore is strong in pharma and biotech, while Chennai is key for auto components and cross-border trade. We also cover domestic trade hubs like Jaipur, Ahmedabad, and Lucknow, strategically selected for their connectivity and volumes.”

He adds, “Air freight accounts for about 40% of our total shipments — primarily for sectors like pharma, healthcare, retail, and auto. The remaining 60% relies on ocean freight for large-volume cargo like garments and capital goods. Our integrated approach ensures both speed and cost-efficiency.”

Together, these logistics players and airport ecosystems are powering India’s next phase of air cargo growth — resilient, digitised and globally connected.

High-value sectors take the lead

India’s cargo mix is also undergoing a strategic shift. Traditional mainstays like apparel and footwear, which previously contributed heavily to export tonnage, are on the decline. “We are definitely seeing a shift in that market away from India,” says Horst.

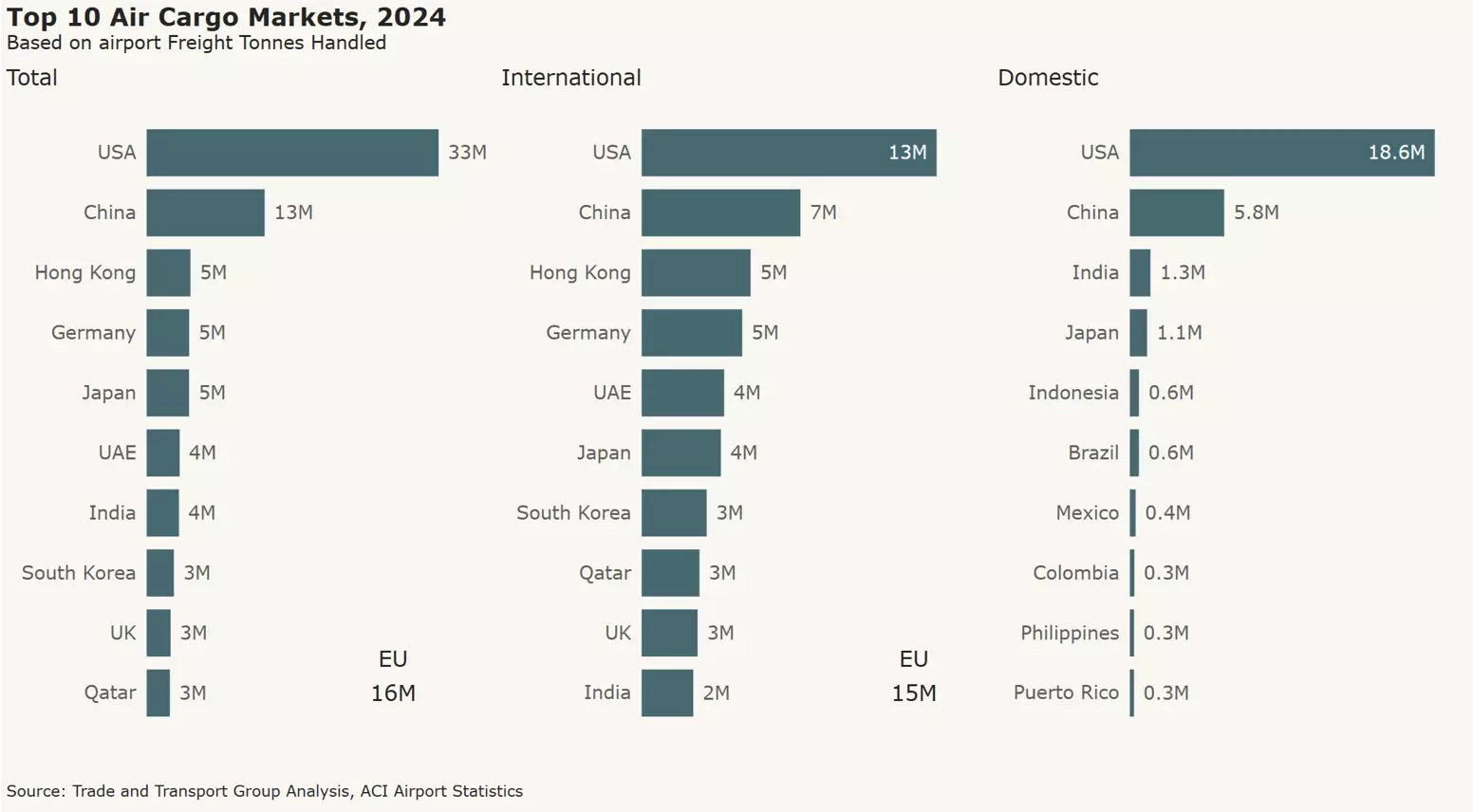

In contrast, electronics — particularly mobile phones — have become a major volume driver, thanks to the government’s Production-Linked Incentive (PLI) schemes and the expansion of high-tech manufacturing hubs. “Air freight exports to the US have been performing well — they are about 27% higher than in 2019, driven primarily by industrial equipment and parts, mobile phones,” notes Horst.

Another standout is the pharmaceutical sector. Although overall pharma exports have grown, more of that cargo is now moving by sea. Still, pharma shipments by air to Europe have remained strong. “Pharma traffic by air to Europe has performed well and is actually 46% higher than it was in 2019,” Horst points out. This reflects both continued European demand and India's reputation for producing high-quality, time-sensitive medical goods.

Adding to this shift is a realignment of strategic trade lanes. “Domestically, routes connecting Mumbai, Delhi, Bangalore, and Chennai remain the busiest. Internationally, lanes to Europe, North America, and Southeast Asia are critical due to their trade volumes and industrial linkages,” adds Kumar.

Operators are also strengthening their presence on key international corridors. “We’re focused on expanding our network across the UK, Germany, France, China, Korea, and the USA — especially in sectors like pharma, electronics, and retail where demand is surging,” notes D’Souza.

By leveraging this expansive network, players like Jeena & Company continue to deliver tailored, efficient logistics solutions across industries, reinforcing India's growing role in the global air freight ecosystem.

Trade dynamics and risks on the horizon

India’s growing prominence in global air freight is also shaped by broader geopolitical and trade dynamics. With the US and Europe diversifying supply chains away from China, Indian exports are gaining traction. However, Horst flags a potential concern: “Given the level of growth we have seen in the US, there is always a danger that this may get reversed due to trade policy measures. The US is running a bigger trade deficit with India than with Mexico and Canada.”

This underscores the fragility of India’s export-led air freight growth, which remains vulnerable to external economic policies and shifting geopolitical alliances.

“Our Coolport terminal is built with over 20 specialised cold rooms and IoT-enabled tracking for real-time control.”

Manish Agnihotri, WFS India

Apart from that Jeena & Company also notes that challenges like aircraft capacity constraints, rising airport and fuel costs, fast-moving tech advancements, and geopolitical disruptions continue to add operational complexity and financial pressure on the air cargo industry — particularly during peak seasons or in times of global tension.

Looking ahead

Looking toward 2030, the outlook for India’s air cargo sector remains highly optimistic. With projected growth in high-value exports, digital trade, and cross-border e-commerce, air freight is set to play an increasingly central role in India’s trade narrative. Infrastructure investments — including dedicated freight corridors, cargo village developments, and widespread digitisation — will be key enablers in this next phase of transformation.

“The government has recognised the growth potential of the industry and has actively supported it. The expansion of freighter operations and dedicated cargo terminals has eased congestion and improved access. We’re also tapping into regional airports like Cochin and Coimbatore to support tier-2 and tier-3 connectivity,” added Jeena & Company’s D’Souza.

He adds that policy and digital reforms are having a tangible impact on efficiency: “Faster customs processes, like single window clearance and e-Sanchit, have reduced delays for time-sensitive cargo. The adoption of Cargo Community Systems is aligning well with our automation efforts, and trade agreements — like the FTA ( Free Trade Agreement) with Australia — have helped expand our international footprint.”

While Horst did not comment on specific government initiatives, he affirmed the broader trajectory: India’s air cargo industry is no longer playing a supporting role. Instead, it is fast emerging as a strategic lever in the country’s trade and logistics ambitions—connecting Indian goods to global markets with greater speed, precision, and technological sophistication.

- AirCargoIndiaIndianAirFreightCargoGrowth2025BLRAirportDelhiAirportCargoMumbaiAirportChennaiCargoInternationalAirCargoDomesticAirFreightPharmaLogisticsPerishableCargoCoolChainKuehneNagelJeenaAndCompanyWFSIndiaTradeAndTransportIndiaExportLogisticsIndiaAirFreightTrendsCargoInfrastructureSupplyChainIndiaFreightForwardingEcommerceLogisticsHighValueCargoPLIExportsCargoDigitizationSmartLogisticsMakeInIndiaExportsCargoHubIndiaAirCargoNews

Rajarshi Chatterjee

Rajarshi is an editorial professional with nearly a decade of experience in writing content for print and online publications. He has hosted numerous entrepreneurship events and moderated sessions at various events, including Flower Logistics Africa. He has previously worked with reputable organizations such as YourStory, YouGov, Inc42, and Sportskeeda and has catered to a diverse range of clients, including Google, PhonePe, the Karnataka State Government, and the Rajasthan State Government. In addition to writing, he enjoys watching films, cooking, and exploring offbeat locations in India.