Indian air cargo to handle 5.8 million tonnes by 2029

The Indian international air cargo market outperformed both the global and Asia Pacific average and is on track for around 19 percent growth in 2024.

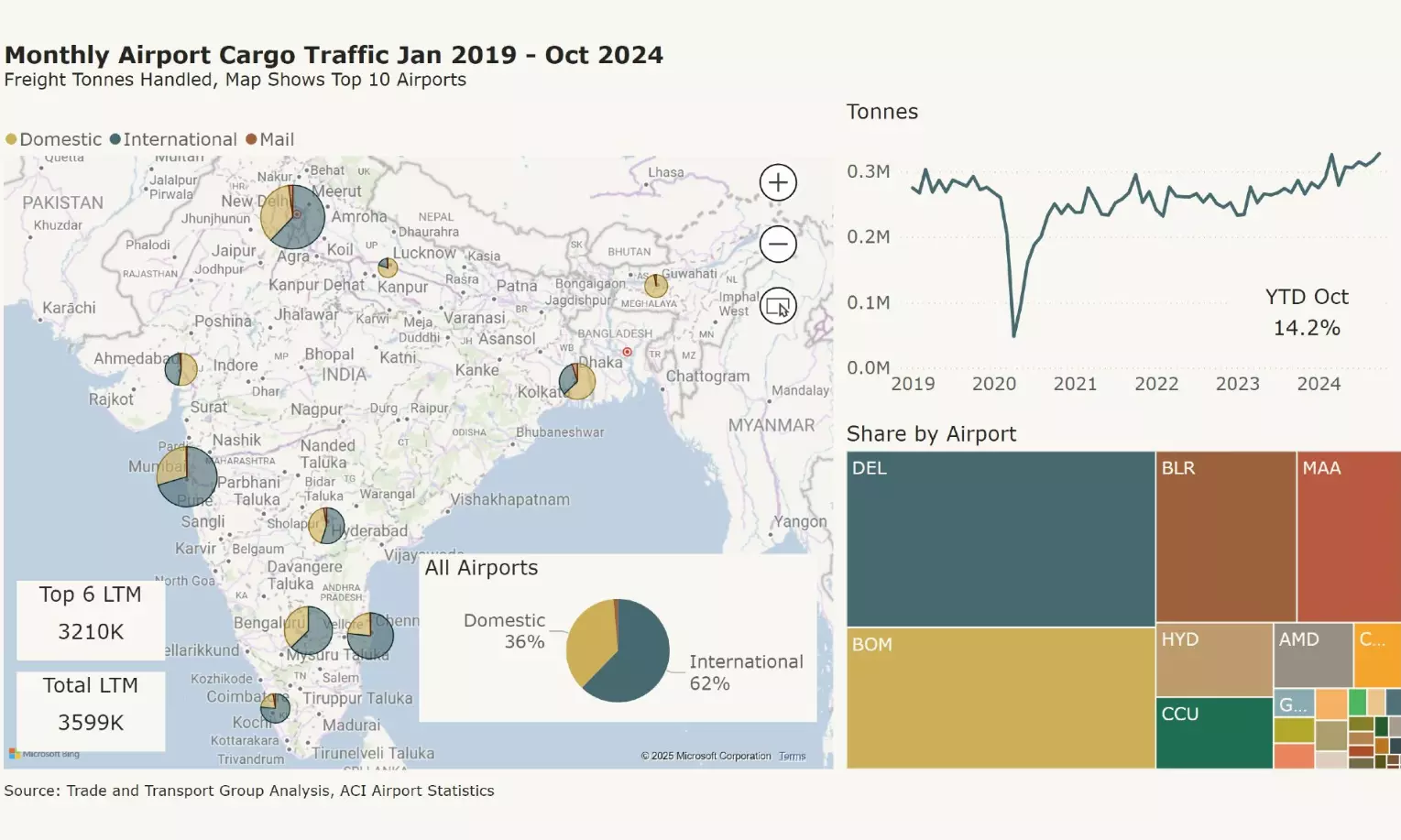

Indian Airport Cargo Traffic Jan 2019 - Oct 2024

Over the next five years, Indian air cargo traffic is expected to grow from 3.7 million tonnes today to between 5 and 5.8 million tonnes by 2029 or about 6-9 percent per year.

The forecast range for Indian air cargo volumes in the next five years is between 6.2 and 9.1 percent. This is higher than recent performance, but in line with longer-term performance through 2019, according to the India Air Cargo Outlook 2025-2029 by Trade Data Service by Trade and Transport group published in January 2025.

“Strong expected economic and trade growth is likely to drive additional air cargo volumes over the next five years. We expect the Indian air cargo market to outperform the overall global air cargo market,” reads the report.

2024, the year of recovery

Talking about the current air cargo numbers and data available till October 2024, the report announced that the recovery of the Indian air cargo market appears to be complete. “Both international and domestic volumes higher than their respective 2018 and 2019 peak levels,” it reads.

“India's air cargo market has done well in 2024,” wrote Frederic Horst, Managing Director, Trade and Transport Group, in a LinkedIn post.

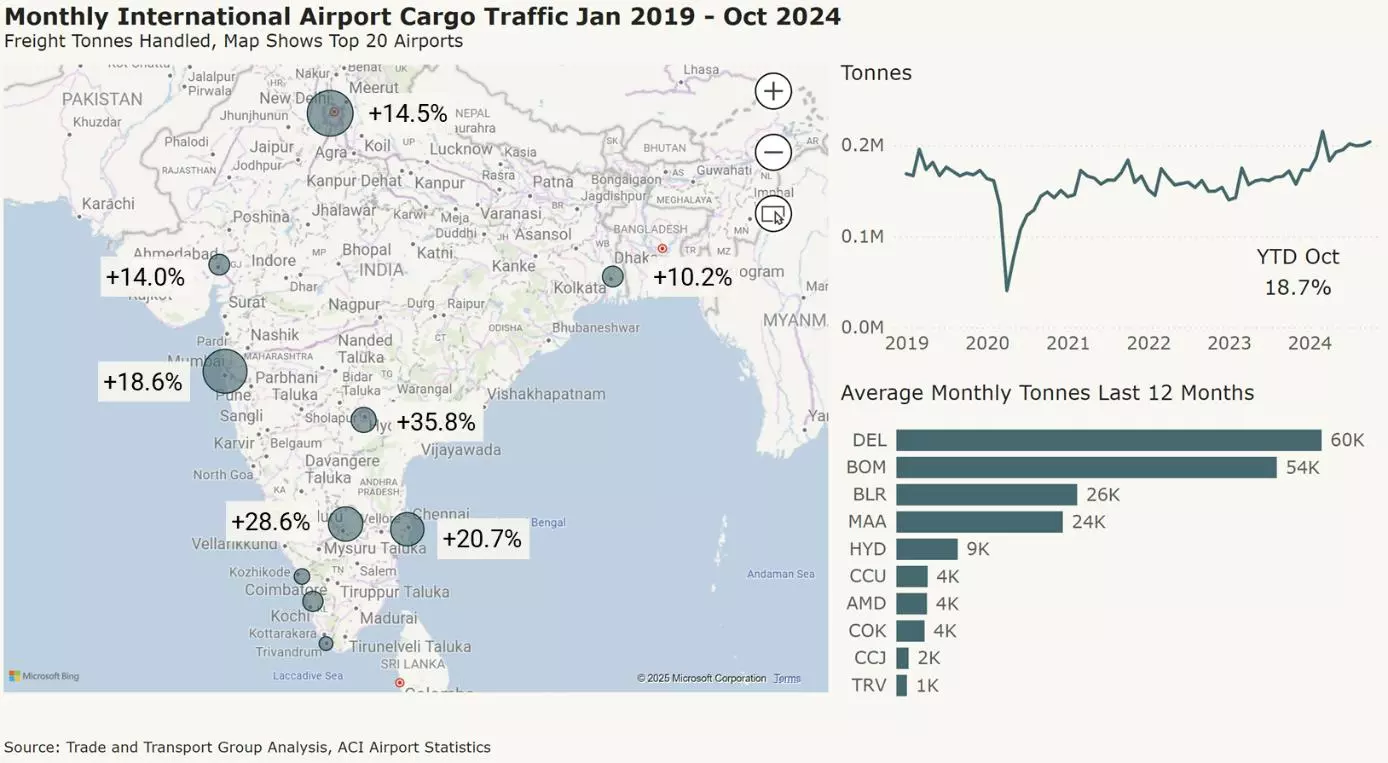

The Indian international air cargo market outperformed both the global and Asia Pacific average and is on track for around 19 percent growth in 2024. Indian domestic air cargo grew between 6 and 8 percent. Overall airport tonnage handled is expected to be in the order of 14 percent, according to the report.

In terms of Indian international air cargo volumes, the report noted that “Delhi and Kolkata underperformed, while Southern Indian airports showed above average performance.”

Ninety percent of India’s air cargo is handled at six airports – Delhi (DEL), Mumbai (BOM), Bengaluru (BLR), Chennai (MAA), Hyderabad (HYD) and Kolkata (CCU).

While Delhi underperformed internationally, domestic volumes increased by 14 percent. “Carrier level traffic indicated growth of about 7 percent for the same period,” it reads.

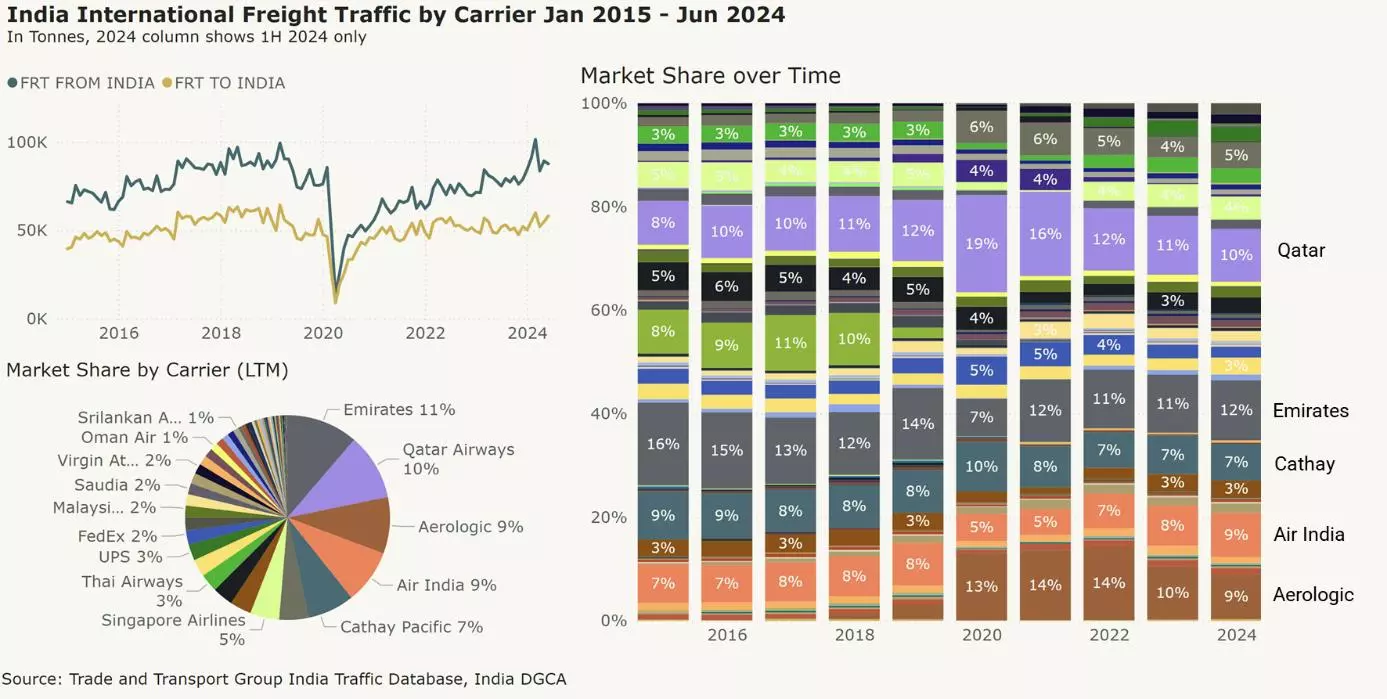

At a route level, data for the first half of the year shows strong performance for Southeast Asian freight, but weaker performance in other markets.

“Direct India to Europe as well as traffic via the Gulf accounts for about two-thirds of Indian international air cargo. Year-to-date trade data through to October shows an increase of air trade between India and Europe in the order of 16 percent compared to 2023,” it reported.

Citing the widebody fleet order backlog of both Air India and IndiGo, Trade Data Service is expecting Indian carriers to increase their share of their home market.

“At a carrier level, the three main Gulf carriers Emirates, Qatar and Etihad have a combined market share of one-quarter of Indian international freight. Indian carriers have a combined market share of between 13-15 percent.”

In the domestic traffic, Indigo enjoys a market share of 38 percent followed by the combined market share of all Air India Group airlines with 30 percent. “Express operator Blue Dart has a 19 percent market share. Amazon’s subcontractor Quikjet only moves about 2 percent of the market,” it reads.

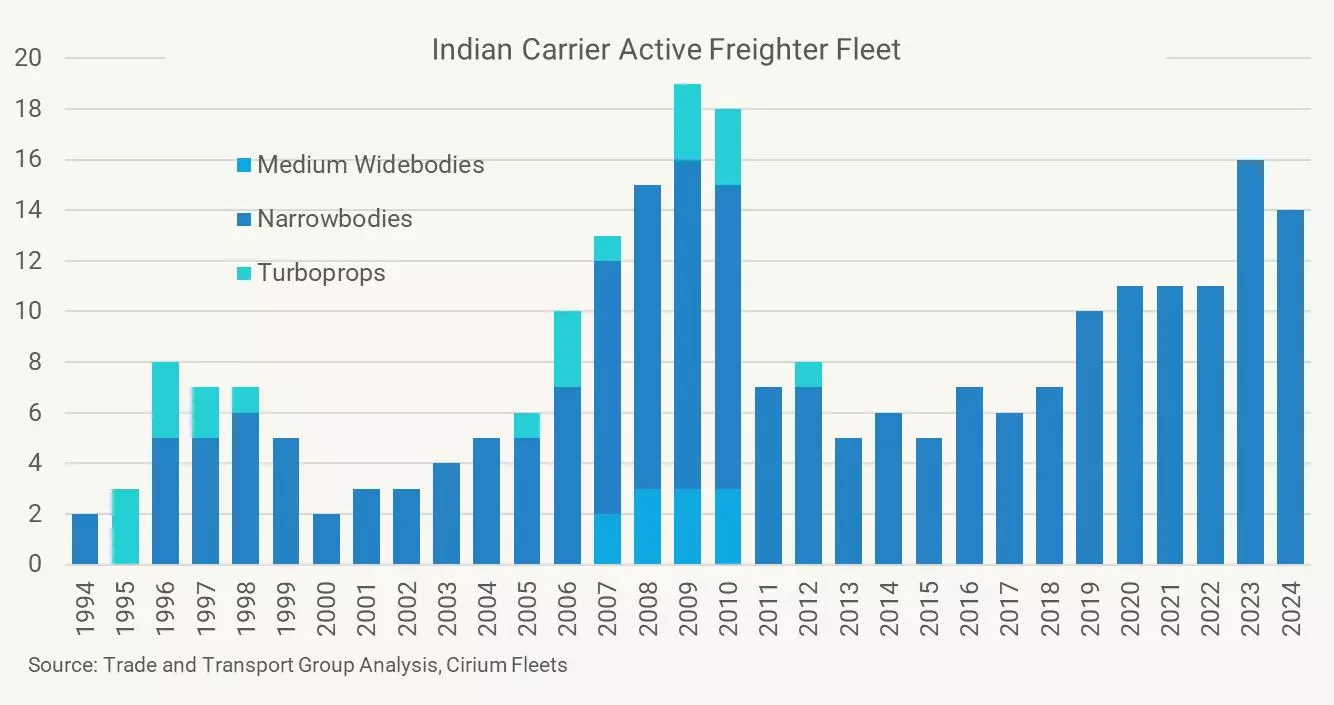

Absence of widebody freighters

The report points out the non-existence of India-domiciled large widebody freighters as a notable feature of the Indian air cargo market. The current Air India and Indigo aircraft order backlog also does not foresee any freighters.

Horst wrote, “Interestingly, despite being the world's 5th largest air cargo market, India-domiciled carriers collectively operate less than 20 freighters. And that is also less than in 2009/2010, even though air cargo volumes are twice as high as then.”

Indian carriers (Blue Dart, IndiGo, Pradhaan Air Express and Quikjet) operate 14 freighters, all of which are narrowbodies. Three SpiceXpress 737-700 remain parked. New entrant carrier Afcom Cargo shows one aircraft in operation and is expected to activate a second unit shortly.

Libin Chacko Kurian

Assistant Editor at STAT Media Group, he has six years of experience in business journalism covering food & beverage, nutraceuticals and now logistics. His current passion is to understand the nuances of global supply chains and their current turmoil. Outside work, he is also interested in philosophy, history, birding and travelling. Mail him: libin@statmediagroup.com Follow on LinkedIn