China, India dominate 2021 Agility Emerging Markets Logistics Index

February 10, 2021: Asia Pacific nations lead all emerging market regions with China, India and Indonesia being the world’s top emerging markets in the 12th annual Agility Emerging Markets Logistics Index, a broad gauge of competitiveness based on logistics strength and business fundamentals.

February 10, 2021: Asia Pacific nations lead all emerging market regions with China, India and Indonesia being the world’s top emerging markets in the 12th annual Agility Emerging Markets Logistics Index, a broad gauge of competitiveness based on logistics strength and business fundamentals.

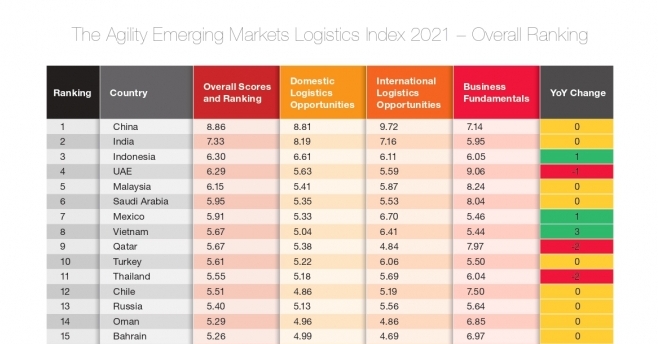

The Index ranks 50 countries by factors that make them attractive to logistics providers, freight forwarders, shipping lines, air cargo carriers and distributors. Among ASEAN countries, Vietnam climbs three spots to No. 8 overall. Indonesia (3), Malaysia (5) and Thailand (11) are strong; the Philippines rises one spot to No. 21.

India holds on to the 2nd position overall for the third consecutive year. Across 50 countries, China, India and Indonesia rank highest in the Index for domestic logistics. China, India and Mexico are on top for international logistics with Vietnam 4th, Indonesia 5th, and Malaysia 7th. UAE, Malaysia and Saudi Arabia have the best business fundamentals.

China and Vietnam were virtually alone in the world in 2020, posting positive GDP growth for the year after being hit early by economic fallout from the Covid-19 pandemic.

Exodus from China

Early 2020 supply disruptions in China prompted some to question whether it would experience an exodus of manufacturing by multi-nationals seeking to diversify sourcing and production. But the 1,200 logistics industry executives surveyed for Agility’s Index indicate little desire to uproot from China or other markets, preferring by a two-to-one margin to protect their supply chains by accelerating adoption of digital tools and technology (41.3 percent) as opposed to pursuing multi-shoring, near-shoring or reshoring strategies (21.9 percent).

Of those who would consider moving out of China, more respondents chose Vietnam as a preferred production hub than any other country (19.6 percent). Other Asian markets – India (17.4 percent), Indonesia (12.4 percent), Thailand (10.3 percent) and Malaysia – are the next leading choices. Only 7.8 percent of industry executives say relocating production from China would mean reshoring to their home countries.

Asia-Pacific is the region that more respondents believe will recover from the global pandemic by the end of 2021. Of those surveyed, 55.9 percent predict an Asia-Pacific economic recovery in 2021; 53.1 percent believe Europe will rebound.

Andy Vargoczky, SVP of sales & marketing Asia-Pacific, Agility GIL, said, “India, Indonesia, Malaysia, Thailand and Vietnam continue to improve their supply chain infrastructure and capabilities, showing why they are leaders in domestic and international logistics.”

2021 Index and survey highlights

● The most competitive emerging markets are manufacturing powerhouses in Asia and the business-friendly economies in the Gulf region. From Asia, China (1), India (2), Indonesia (3), Malaysia (5) and Vietnam (8) made the top 10. Gulf nations United Arab Emirates (4), Saudi Arabia (6), Qatar (9) also ranked in the top 10. Mexico came in at 7th; Turkey was No. 10.

● In Latin America, Mexico is the strongest emerging market, ranking 7th overall. Argentina (36) and Venezuela (50) continue to be plagued by chronic economic dysfunction. Notably, though, eight countries in Latin America improved their business fundamentals: Uruguay, Mexico, Peru, Colombia, Ecuador, Brazil, Paraguay, and Bolivia. The region’s best business climate is in Chile, which ranks 5th out of 50 countries in that category.

● Nigeria improved its competitiveness more than any country in the 2021 Index, moving up five spots to No. 30, the highest climb for any market in Sub-Saharan Africa in the 12 years of the Index. Nigeria improved its relative position in all three areas of the Index: business climate, international logistics and domestic logistics.

● The countries improving their domestic logistics strengths the most were Malaysia, Nigeria, Vietnam, Iran, Uruguay, Myanmar and Cambodia. The biggest strides in international logistics came from Morocco, Ukraine, Kenya, Myanmar and Paraguay.

Transport Intelligence (Ti), a leading analysis and research firm for the logistics industry compiled the Index.

John Manners-Bell, chief executive of Ti, says: “Although some – especially China and Vietnam – have been able to rebalance around domestic industrial and consumer demand, the majority are still highly dependent on international markets and investment. A lack of global demand, combined with the breakdown of air and sea logistics networks, has had severe consequences for these economies and societies.”