Coronavirus: Read how much Indian automotive supply chain is exposed to China

February 21, 2020: The outbreak of Novel Coronavirus (COVID -19 ) across China and South -East Asia, which has already killed 2200 people, has potential to impact the Indian automotive industry, due to its exposure to the Chinese market.

February 21, 2020: The outbreak of novel coronavirus (COVID -19 ) across China and South -East Asia, which has already killed 2200 people, has potential to impact the Indian automotive industry, due to its exposure to the Chinese market.

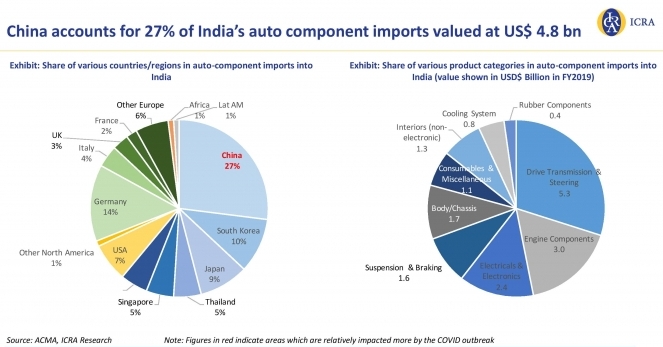

“China accounts for 27% of India’s auto component imports valued at $ 4.8 billion,” says the report released by the credit rating agency, ICRA with talks about the degree of exposure, multiple auto components involved and its impact on the supply chain.

"The recent outbreak of coronavirus across China and neighbouring South-East Asian countries has the portential to impact the automotive industry in India, given the important role played by these countries in the automotive supply chain,” said Subrata Ray, senior group vice president, ICRA.

Mr. Subrata Ray, Senior Group Vice President, ICRA, shares his views on Coronavirus outbreak in China and neighboring countries and its impact on the automotive industry in India. #ICRAViews #AutomotiveIndustry #Automobile #COVID2019 pic.twitter.com/4EPeSgKGiN

— ICRA (@ICRALimited) February 18, 2020

India depends on China for 39 percent of steering system components, 31 percent of lighting system components, 25 percent of braking system components, 22 percent of tyres/tyre components, 19 percent of engine components and 14 percent of exhaust system components.

Source of OEMs

OEMs in India source critical components and sub-components including fuel injection pumps, EGR modules, electronic components and turbochargers from these markets, which directly or indirectly depend on China.

High-value components

Impact would be higher for high value -add and customized components, while commoditized products like LEDs and metal could shift to alternative suppliers. High investments and gestation period involved in developing tooling remain the key prohibitive factor for an immediate shift to new suppliers.

Inventory maintained

While companies are currently maintaining a 4 - 6 weeks of inventory, given the stock up done prior to the Chinese new year, there would be potential supply disruptions if the situation persists for another couple of weeks.

BS-VI transition

Additionally, given that OEMs are currently in the period of transitioning to BS-VI production, disruption in the supply of critical components required for the same has the potential to impact the smooth transition to the new emission norms.