DP World registered 36.1 percent revenue growth in 2019

March 13, 2020: DP World announced the financial results for the year ended December 31, 2019 with revenue growth of 36.1 percent and adjusted EBITDA increase of 17.7 percent with an adjusted EBITDA margin of 43 percent, delivering profit attributable to owners of the Company, before separately disclosed items, of $1,328 million, up 4.6 percent and

March 13, 2020: DP World announced the financial results for the year ended December 31, 2019 with revenue growth of 36.1 percent, adjusted EBITDA increase of 17.7 percent and an adjusted EBITDA margin of 43 percent, delivering profit attributable to owners of the Company, before separately disclosed items, of $1,328 million, up 4.6 percent and EPS of 160.0 US cents.

I am proud of the creativity and ingenuity of our employees around the world who continue to help our business grow, innovate and advance its mission to deliver truly integrated supply chain solutions to cargo owners. pic.twitter.com/9IQNPE5qNp

— Sultan Ahmed Bin Sulayem (@ssulayem) March 12, 2020

Results Highlights

• Revenue of $7,686 million

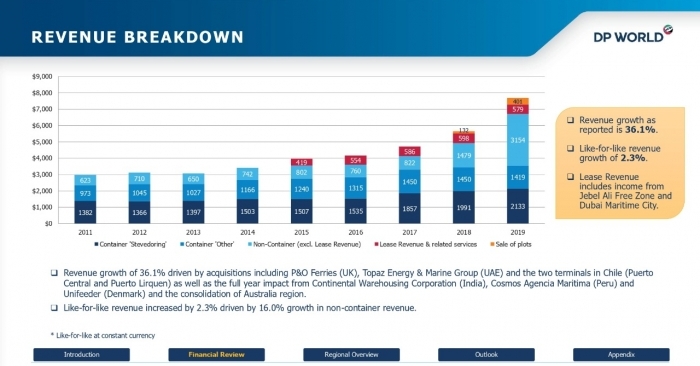

o Revenue growth of 36.1 percent driven by acquisitions including P&O Ferries (UK), Topaz Energy & Marine (UAE) and the two terminals in Chile (Puerto Central and Puerto Lirquen) as well as the full-year impact from Continental Warehousing Corporation (India), Cosmos Agencia Maritima (Peru) and Unifeeder (Denmark), and the consolidation of Australia region.

o Like-for-like revenue increased by 2.3 percent driven by 16.0 percent growth in non-container revenue.

• Adjusted EBITDA of $3,306 million and adjusted EBITDA margin of 43.0 percent

o Adjusted EBITDA grew 17.7 percent and achieved an EBITDA margin for the full year of 43.0 percent.

o Like-for-like adjusted EBITDA margin was at 49.6 percent.

• Profit for the period attributable to owners of the Company of $1,328 million

o Strong adjusted EBITDA growth resulted in a 4.6 percent increase in profit attributable to owners of the Company before separately disclosed items on a reported basis and 5.4 percent growth on a like-for-like basis at constant currency.

• Strong cash generation and robust balance sheet

o Cash from operating activities was $2,462 million.

o Free cash flow (post cash tax maintenance capital expenditure and pre-dividends) amounted to $2,058 million.

o Leverage (Adjusted Net Debt to adjusted EBITDA) at 3.9 times. Pre IFRS 16 leverage stands at 3.4 times.

• Proposed Total dividend per share of 40 US cents

o Proposed ordinary dividend of 40 US cents which is broadly in line with the historic pay-out ratio.

• Bond Transaction Executed at Record Levels

o Raised $2.3bn through the issuance of long-term bonds at record low rates to remove refinancing risk.o Further strengthens balance sheet and offers financial flexibility.

Sultan Ahmed Bin Sulayem, group chairman and CEO, DP World said "DP World is pleased to report like-for-like earnings growth of 5.4 percent in 2019 and attributable earnings of $1,328 million. Adjusted EBITDA grew 17.7 percent to $3,306 million with margins at 43.0 percent on a reported basis and 49.6 percent on a like-for-like basis. This performance has been delivered in an uncertain trade environment, once again highlighting the resilience of our portfolio. We have continued to make progress on our strategy to deliver integrated supply chain solutions to cargo owners and have focused our efforts on building end-to-end capabilities for several verticals including the Automotive, Oil & Gas and FMCG industries. We are pleased to state that cargo owners have responded positively, and we are now delivering efficient solutions to our customers, which bodes well for the future.”

More recently, after much deliberation, DP World has taken the decision to announce its plans to de-list its equity from the stock exchange and return to private ownership.

"Following the planned delisting, the leverage on the balance sheet will rise temporarily but we are confident of de-leveraging as we remain committed to a strong investment-grade rating in the medium term. The business continued to generate high levels of cash flow and combined with more disciplined investment and potential capital recycling; we have enough flexibility to maintain a strong balance sheet. Our immediate focus is to integrate our acquisitions and explore synergies with the objective of providing a range of smart end-to-end solutions which will improve the quality of our earnings and drive returns. The near-term outlook remains a cause for concern with global trade disputes, Covid-19 outbreak and regional geo-politics, causing disruption to trade. However, DP World is well-positioned to respond in the short term by focusing on disciplined investment and managing the cost base to protect profitability. Overall, we remain positive on the medium to long term outlook of the industry,” he added.

“Finally, the Board of DP World recommends a dividend of $332.0 million at 40 US cents per share, which is in line with the past policy of maintaining a payout ratio of at least 20 percent," he said.

Indian overview of DP World

Key logistics and maritime developments of DP World in India

Asia-Pacific/India share of DP World investments

Click here for the complete breakdown of DP World 2019 financials.