D2C brands estimated to become a $60 billion industry by FY27: Report

Many D2C brands across the nation have crossed the Rs100-crore benchmark in revenue. As per the Shiprocket-CII-Praxis report, grocery, gourmet, apparel and footwear, and personal care are the largest D2C categories, collectively capturing more than 75% of the D2C market

Shiprocket, India's largest eCommerce enablement platform, has released a report on the D2C market in India in collaboration with CII (Confederation of Indian Industries) and Praxis Global Alliance, a global management consulting and advisory services firm.

As per the report, Direct to Customer (D2C) is a $12 billion market and is witnessing remarkable and rapid growth. The report states that several D2C brands in India have crossed Rs 100Cr revenue in 3-5 years after the launch.

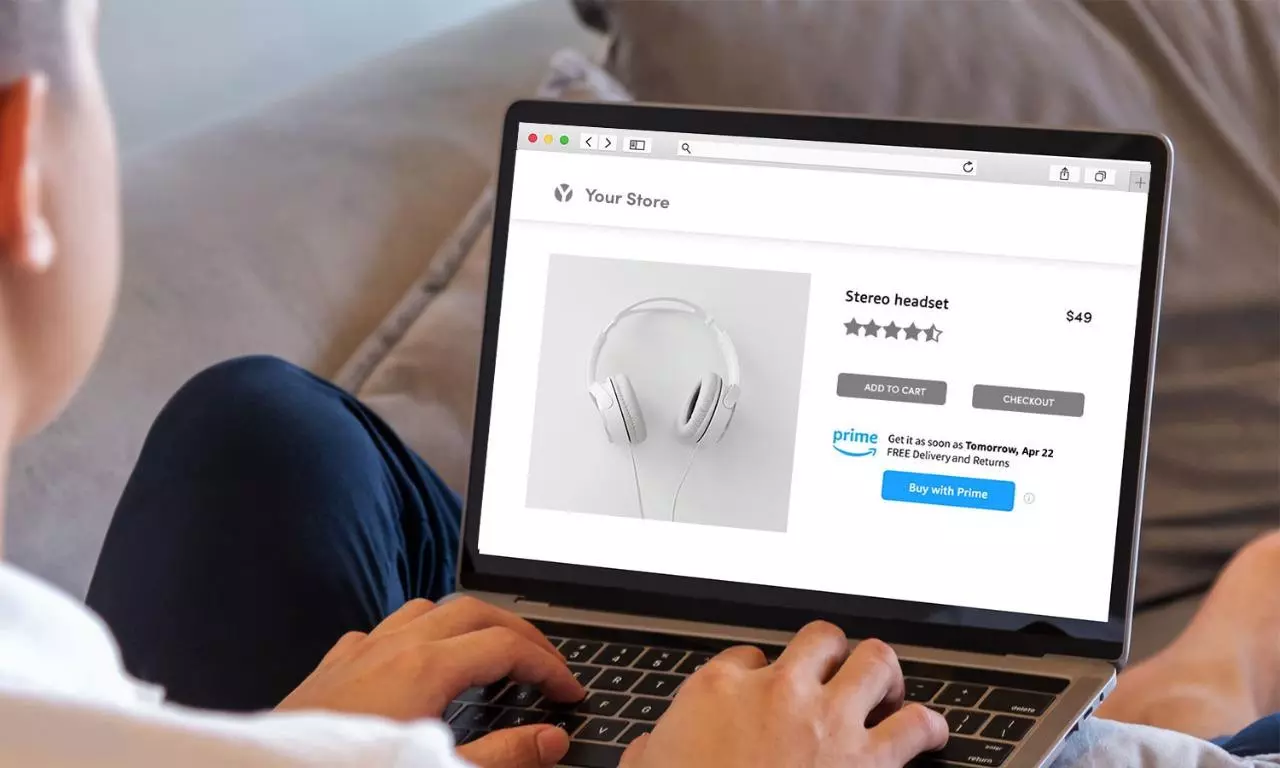

The latest report reveals that D2C brands are estimated to be $60 billion industry by FY27, registering a CAGR of about 40%. The numbers in the report are staggering, paving the way for a new model of e-commerce wherein brands choose to own and operate their own sales counters on the web. This notable trend has been reaffirmed by the fact that many D2C brands across the nation have crossed the INR 100-crore benchmark in revenue. On top of that, this revenue benchmark was only achieved in 3-5 years since launching operations.

Aiding these trends is the brands' agility and Go-To-Market (GTM) strategy, alongside strong digital capabilities that have helped their businesses soar and achieve a competitive edge. The report shows that brand packaging has also been an essential factor in attracting buyers. The Average Order Value (AOV) on each product and a hefty gain in gross margins are the fundamental tailwinds that further foster this trend.

Speaking on the report launch, Saahil Goel, Co-Founder, and CEO of Shiprocket said, "The rise of online-first shopping behavior and conscious consumerism fueled the era of direct-to-consumer (D2C) brands. Today, brands are not limited to only marketing their products through online marketplaces or offline channels, rather many brands are developing their own eCommerce stores or apps with the aim of capturing orders and delivering them with the help of eCommerce enablers straight to the customers. With technological barriers taking a side-step and building blocks of direct selling strengthening, this trend is furthering to newer heights. The rationale for direct selling is the same online as offline. Brands create their own brand stores and also sell in department stores or multi-brand outlets as they can control the brand experience in their own stores. Similarly, direct-to-consumer online channels offer brands the ability to control the narrative and brand experience."

He further added, "With this report, our aim is to provide the first-ever comprehensive deep dive of the D2C sector in India and its tremendous potential in the coming years."

Commenting on the launch, Mohit Mittal, Partner of Praxis Global Alliance, said, "The Indian e-commerce market is growing rapidly (projected CAGR of ~25% from FY22 to FY27). We've seen that almost all pin codes in India are using e-commerce. Many of these transactions and orders come from tier two cities and smaller towns. By FY30, India will also have 1.3B+ smartphone users and 500M+ online shoppers. The growing e-commerce sector positively influences the growth of D2C brands in India. With more people shopping online and more money being spent by consumers, the market is likely to increase over the next five years. To reduce their reliance on the marketplaces, even traditional brands are increasingly developing their direct-to-customer channels such as website, app and social media handles to reach out and sell to their customers."

To estimate the size of the D2C market in India, we have considered seven categories: personal care, clothing and footwear, groceries and refined foods, jewelry, electronics, health care, home furnishings, and garden. Incumbent players (such as Unilever, Marico, Tata Consumer Products, and ITC) are either acquiring prominent D2C brands or choosing the organic route of launching their own brands online and building their own D2C platforms. However, for D2C brands to maintain this growth, they need to strengthen product innovation and revamp manufacturing and sourcing strategies to become market leaders. So, to win the market, it is also essential to improve offline distribution, customer acquisition, and unit economics.

- Direct to Customer (D2C)D2C brandse-commerceGo-To-Market (GTM) strategydigital capabilitiesbrand packagingAverage Order ValueeCommerce enablement platformoffline distributioncustomer acquisitionunit economicspersonal careclothing and footweargroceries and refined foodsjewelryelectronicshealth carehome furnishingsgarden