Festive season demand drives healthy 3QFY21 results in logistics: Ind-Ra

March 24, 2021: India Ratings and Research (Ind-Ra) has published the January 2021 edition of its credit news digest on India’s logistics sector highlighting the key volume and realisation trends across three logistics sub-sectors – sea logistics (global and domestic), surface logistics (rail and road) and air logistics (passenger and freight).

March 24, 2021: India Ratings and Research (Ind-Ra) has published the January 2021 edition of its credit news digest on India’s logistics sector highlighting the key volume and realisation trends across three logistics sub-sectors – sea logistics (global and domestic), surface logistics (rail and road) and air logistics (passenger and freight).

Festive season, pent-up demand drives strong 3Q profitability

Logistics companies reported healthy 3QFY21 results on the back of improving volume momentum which drove healthy revenue growth and helped sustain improvement in EBITDA margins. During 3QFY21, a strong increase of 37 percent YoY in the cargo volumes handled, partially supported by the acquisition of Krishnapatnam Port, led to strong revenue growth for Adani Ports & SEZ.

Even after excluding Krishnapatnam Port numbers, the growth in volumes was broad-based and its market share for Mundra port as well as in the container segment continued to witness a sequential improvement. For container freight station and inland container depot players, realisations remained under pressure in 3QFY21 even though they were higher than last year; meanwhile, domestic as well as EXIM volumes showed positive growth momentum in 3QFY21.

For Navkar Corporation, 3QFY21, the profitability was supported by a continued capacity ramp-up at the Vapi facility and strong revenue momentum at the private freight terminal operations.

For multimodal logistics players, 3QFY21 volumes were supported by the normalising movement of goods, pent-up demand and festive season. A sharp focus on cost control helped secure stable margins. The strong 3Q volume momentum was also driven by a revival in automobile demand and continued strength in e-commerce and FMCG.

Overall, Ind-Ra believes sustained strength in volumes coupled with the ability to pass on recent fuel price hikes remains a key rating monitorable in the coming months.

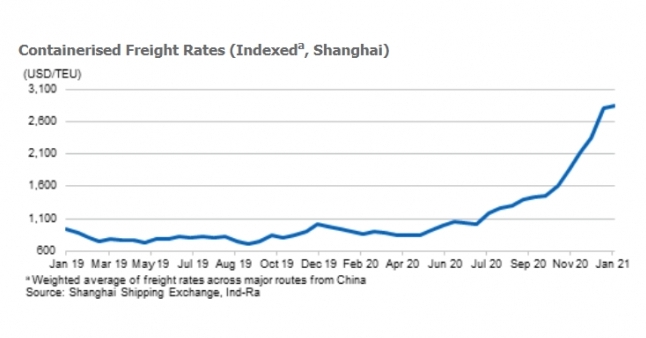

Container freight rates remain elevated amid shortage

Amid a shortage of containers globally, container freight rates in January 2021 rose 192 percent YoY, disrupting trade flows across the world. Even as the port recovery continues, Ind-Ra believes trade flows may take a few months to normalise, leading to elevated freight rates, especially in 1HFY22.

The container shortage is attributable to regular trade flows being interrupted due to the global lockdowns. While the lockdowns have been eased since then, adequate container availability in key locations has still not been achieved. Also, the pace of recovery has varied across regions e.g. Chinese economy and its exports rebounded from the pandemic much earlier than the rest of the world, leading to an imbalance in the imports and exports from China.

Road, port volumes continue to improve; risks to aviation rise

India’s port volumes continued to grow positively in January 2021 (up 4 percent YoY) for the third consecutive month (December 2020: up 4 percent YoY) even as monthly (mom) growth declined to 1 percent (December 2020: up 7 percent mom).

Road, as well as rail volumes, continued to grow in January 2021, amid stable truck freight rates despite rising diesel prices. E-way bill generation too grew 10 percent YoY to 63 million in January 2021, though it declined 2 percent, mom. Railway volumes, which had been impacted because of the lockdown, have witnessed a healthy recovery from August 2020 to January 2021.

Domestic passenger traffic rose 5 percent mom in January 2021, although was down 39 percent YoY, while international passenger traffic rose 11 percent mom (down 77 percent YoY). In domestic operations, the passenger load factor stood at 65-77 percent during January 2021. In February 2021, the government increased the upper and lower cap on airfare by 30 percent as a way to support airlines. Also, the agency believes mass-scale vaccination should be supportive of air travel recovery. However, the recent increase in Covid-19 cases has raised the risk of states placing restrictions on inter-state travel which could pose risks to a sharp recovery.