Global air cargo posts strongest first half-year growth since 2017

July 30, 2021: The International Air Transport Association (IATA) released data for global air cargo markets for June showing a 9.9 percent improvement on pre-Covid-19 performance (June 2019). This pushed the first half-year air cargo growth to 8 percent, its strongest first-half performance since 2017 (when the industry posted 10.2 percent year-on

July 30, 2021: The International Air Transport Association (IATA) released data for global air cargo markets for June showing a 9.9 percent improvement on pre-Covid-19 performance (June 2019). This pushed the first half-year air cargo growth to 8 percent, its strongest first-half performance since 2017 (when the industry posted 10.2 percent year-on-year growth).

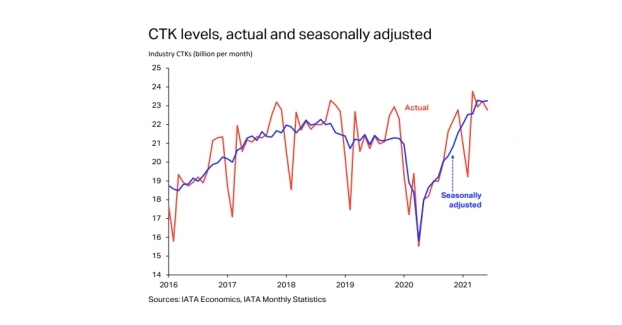

Global demand for June 2021, measured in cargo tonne-kilometres (CTKs), was up 9.9 percent compared to June 2019.

Regional variations in performance are significant. North American carriers contributed 5.9 percentage points (ppts) to the 9.9 percent growth rate in June. Middle East carriers contributed 2.1 ppts, European airlines 1.6 ppts, African airlines 0.5 ppts and Asia-Pacific carriers 0.3 ppts. Latin American carriers did not support the growth, shaving 0.5 ppts off the total.

Overall capacity, measured in available cargo tonne-kilometres (ACTKs), remained constrained at 10.8 percent below pre-Covid-19 levels (June 2019) due to the ongoing grounding of passenger aircraft. Belly capacity was down 38.9 percent on June 2019 levels, partially offset by a 29.7 percent increase in dedicated freighter capacity.

“The cost-competitiveness and reliability of air cargo relative to that of container shipping has improved. The average price of air cargo relative to shipping has reduced considerably. And scheduling reliability of ocean carriers has dropped, in May it was around 40 percent compared to 70-80 percent prior to the crisis.

Willie Walsh, IATA’s Director-General, said, “Air cargo is doing brisk business as the global economy continues its recovery from the Covid-19 crisis. With first-half demand 8 percent above pre-crisis levels, air cargo is a revenue lifeline for many airlines as they struggle with border closures that continue to devastate the international passenger business. Importantly, the strong first-half performance looks set to continue.”

Asia-Pacific airlines saw demand for international air cargo increase by 3.8 percent in June 2021 compared to the same month in 2019. International capacity remained constrained in the region, down 19.8 percent versus June 2019. Even though demand remains high, the region faces moderate headwinds from the lack of international capacity and manufacturing PMIs that are not as strong as in Europe and the US.