Global air cargo volumes recover to pre-Covid level within 10 months

March 4, 2021: A robust global air cargo market has virtually completed its recovery to pre-Covid volume levels inside 10 months, according to airline performance data for February 2021 from industry analysts CLIVE Data Services and TAC Index.

March 4, 2021: A robust global air cargo market has virtually completed its recovery to pre-Covid volume levels inside 10 months, according to airline performance data for February 2021 from industry analysts CLIVE Data Services and TAC Index.

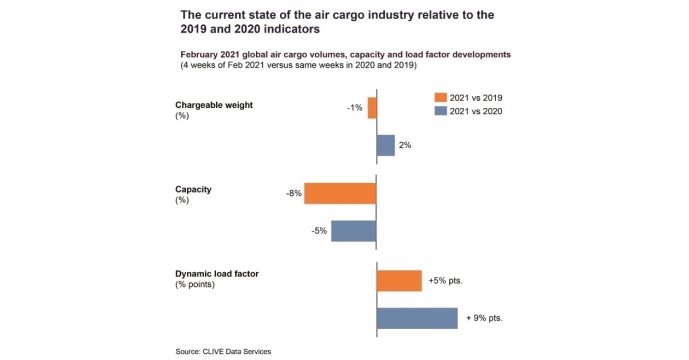

For the four weeks of last month, chargeable weight stood at just -1 precent compared to February 2019 and was 2 precent ahead of the same month of 2020. Niall van de Wouw, managing director of CLIVE Data Services, says airline passenger departments will be ‘dreaming of such a recovery in passenger demand.’

To give a meaningful perspective of the industry’s performance, CLIVE Data Services’ first-to-market data will focus on comparing the current state of the industry in the context of 2019 volume, capacity and load factor developments until at least Q3 of this year. This will be produced alongside the 2020 comparison.

Capacity in February 2021 was -8 and -5 precent versus 2019 and 2020 levels respectively, while CLIVE’s ‘dynamic loadfactor’ - calculated on both the volume and weight perspectives of cargo flown and capacity available – was up +5 precent pts on February 2019 and +9 precent pts on the same month of last year. The overall dynamic load factor of 69 precent was at the same level as January 2021 while month-over-month volumes climbed 7 precent, despite February being three days shorter than January, as capacity rose 5 precent over January.

Niall van de Wouw added: “These are tricky months to compare due to the Chinese New Year and Leap Year variances, so we have to be careful in how we read the market. To give a meaningful view, it makes senses to keep an eye out to 2019 before the pandemic took hold and, on that basis, air cargo demand is now nearly at par with pre-Covid volumes despite much less capacity in the market. If we normalize for last year’s Leap Year, we can see a 2 precent growth in global volumes compared to February 2020 but that does not tell the tale by any measure - the apparently modest global growth number is masking what lies underneath. Volumes from China to Europe, for example, were nearly 5x higher in the four weeks of February 2021 than in the similar weeks in 2020. This was caused by the dramatic drop in volumes because of the factory closures a year ago in response to the COVID outbreak. Volumes from Europe were down by -11 precent for the same period.

“Demand is increasing and there are a lot of passenger planes sitting around that could start flying cargo, but I don’t think that will happen proactively. Given the high financial risks, when it comes to adding capacity, airlines are more likely to follow the market as opposed to trying to stimulate it. But, if it makes sense, they will surely fly those aircraft. Air cargo has been resilient and, bit-by-bit has clawed back the losses we saw only a few months ago. In April 2020, volumes were down -39 precent but are now back to the pre-Covid level. Who would have thought that possible within 10 months? It’s a recovery airline passenger departments will be dreaming of.”

The volume, capacity and load factors continue to be reflected in higher prices, TAC Index says.

Robert Frei, Business Development Director at TAC Index, commented: “Volatility remains high (also intra month) and, given the much higher pricing levels than a year ago, is having a major impact. Looking at PVG-EUR, for example, if you are 10 precent off with your procurement today (which would be RMB 3.20) compared to 2020 levels, it would have meant a deviation of 18 precent. This presents a very risky environment for freight forwarders and potentially an immediate loss on their gross margins of 8-10 precent. So up-to-date pricing information on a weekly basis is an absolute necessity to manage these volatile periods. We also assume the spread of spot rates is likely to remain high.”

The latest data from TAC Index shows that while the monthly pricing average seems ‘mundane’, weekly rate levels reveal a lot of volatility.

TAC Index says the Baltic Exchange Index in February was +2 precent over January, taking into account Chinese New Year starting February 12, which is normally considered peak season. But when looking at the CNY impact on the PVG-EUR lane, compared to previous years, in the two weeks prior/post CNY, TAC Index observed:

• 2019 – overall period +8 precent

• 2020 – overall period -4 precent

• 2021 – overall period -13 precent

February 2021 saw the largest drop in yield, compared to the last two years, during the four weeks around CNY. In absolute terms this period compares as follows:

• 2019 – average RMB 20 /kg

• 2020 – average RMB 17.5 /kg = -11 precent to previous year

• 2021 – average RMB 31 /kg = +79 precent to previous year or +63 precent higher than 2019

TAC Index adds that interesting observations can also be made when comparing PVG with HKG. On the HKG-EUR lane, rates were flat compared to PVG-EUR - which increased by +7 precent. HKG-USA rates went up +2 precent, whilst PVG-USA prices dropped by -1 precent.