How can the supply chain finance assist the Make in India moto

Make in India is a government initiative, launched by prime minister Narendra Modi in September 2014. It is now six years’ old, aiming to increase the share of manufactured products to Indian GDP from 16 to 25 percent by 2025

Make in India is a government initiative, launched by prime minister Narendra Modi in September 2014. It is now six years’ old, aiming to increase the share of manufactured products to Indian GDP from 16 to 25 percent by 2025. It is combined with the “zero defect, zero effect” policy – ensuring that quality standards are raised and proper attention is paid to environmental issues.

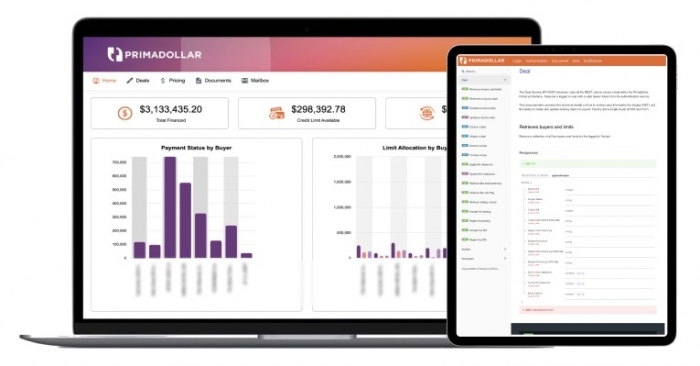

Tim Nicolle of PrimaDollar writes about the importance of standardising and simplifying the funding and payments in supply chains by making it more efficient and keeping costs under control.

As with any government intervention, it can have distorting effects and theory can run into practical challenges when it meets the real world. And, of course, on top of Make in India, we have the Covid-19 pandemic, adding further dimensions to the challenges faced by business.

The overall plan is an ambitious combination of investment in infrastructure and subsidies and benefits that can be used to encourage foreign direct investment and the build of manufacturing infrastructure. It is too early, even after 6 years, really to judge to the success of the initiative, but it is certainly having an effect.

A key focus for the policy is the move of manufacturing from outside India to inside India – especially for products that India itself consumes. So whether this is automobiles, mobile phones or pharmaceuticals, better that they are manufactured in-country for distribution in-country than made overseas and imported on a completed basis. And so this inevitably starts to influence how supply chains are built and operated – and, in turn, how supply chains are financed.

Supply chain finance is well-established technique that is used by large corporates to ensure their suppliers are well-funded at low rates and paid early for their supplies. The domestic supply chain finance ecosystem in India is well-established, with many banks helping larger corporate buyers to ensure that suppliers are paid early and on time. This system benefits all parties. The large corporate has a smooth and standardised approach to supplier payments, and smaller suppliers do not suffer cash flow stress and funding problems. Everyone wins.

But supply chain finance only works in India for domestic supply chains – unlike many countries. This is due, in part, to RBI regulations and the capabilities of local banks. The main task of a supply chain finance program is to make early payments on behalf of large buyers to their suppliers. But this is not something that Indian banks can easily do cross-border. First, the bank has to be able to on-board the international supplier, and second, the bank has to be comfortable making the payment in compliance with the RBI foreign exchange control regulations, in particular. So this has meant that the only supply chain finance solution available historically for cross-border trade for large corporates in India has been the letter of credit – which certainly does work, but at the expense of complexity, fees and time for the importer and exporter who are involved.

Of course, supply chain finance could assist the Make in India program substantially by smoothing the way in which large corporates in India pay and fund their international supply chains as well. In fact, the whole point of Make in India is that the supply chain moves across the border from outside India to inside India. Instead of products being made outside India and imported, the parts and components can be brought in and assembled in-country. India does not, and may be will not for some time, have a fully-developed industrial complex. But many jobs can and are being created in the assembly and construction of products imported via more complex supply chains from offshore sources. This is a win for India – and is one of the quick wins which Make in India easily delivers.

But more complex supply chains require more complex financing and therefore significant costs – unless supply chain finance can be used.

And there is good news on this front, which is the recent development of new technologies that can be used by large corporates based in India to manage how their international suppliers are funded and paid. This is supply chain trade finance – new platforms that have all the convenience and efficiency of the domestic supply chain finance product – but all the reach and scope of the traditional trade finance products, like the letter of credit. And moreover, supply chain trade finance can save as much as 2 percenton the cost of landed goods brought in – which will directly increase the competitiveness of Indian-made products both internationally and domestically.

Supply chain finance – and now supply chain trade finance – both have an important role to play in helping the Make in India program continue towards its 2025 target. Standardising and simplifying how supply chains are funded and paid is very important to keep supply chain efficient and costs under control. Large corporates in India have, historically, been at a disadvantage versus other countries where exchange controls are more relaxed, but new breed of platforms now emerging addresses that imbalance.

| Tim Nicolle is the founder and CEO of PrimaDollar, a UK-based fintech that provides supply chain finance to clients in 31 countries in support of cross-border trades |

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Indian Transport & Logistics News