Indian sea & road freight recovering; air still impacted: Ind-Ra

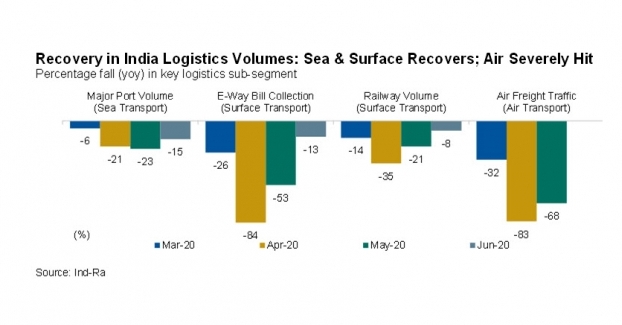

August 7, 2020: India Ratings and Research (Ind-Ra) has published the first edition of its credit news digest on India’s logistics sector highlighting a moderate recovery for sea and road transport post the easing of the lockdown restrictions, whereas air transport remains severely stressed.

August 7, 2020: India Ratings and Research (Ind-Ra) has published the first edition of its credit news digest on India’s logistics sector highlighting a moderate recovery for sea and road transport post the easing of the lockdown restrictions, whereas air transport remains severely stressed.

India’s ports volumes recovered to 80-85 percent of the normal levels in June 2020, after the sharp 21-23 percent YoY drop in volumes during April-May 2020. Imports have been severely hit, while exports have recovered to the pre-Covid levels.

Road transport volumes may also have recovered, as indicated by the e-way bill collection and diesel consumption being at about 85 percent of the pre-Covid levels. However, air transport is reeling under pressure with passenger traffic practically at nil levels and freight traffic at 60 percent of the normal levels in May 2020.

Ocean freight: sluggish imports affect volumes

The overall major port volumes declined 15 percent YoY in June 2020, as against the 21-23 percent decline in the preceding two months, supported by a 26 percent YoY jump in iron ore export from eastern ports. Imports have remained sluggish, while a rebound in export to pre-COVID level led to India’s import-export mix changing to 58:38 (4 percent for transhipment) in June 2020 from the normal split of 65:30. Dwell time for import containers at JNPT Port rose 3x in May 2020 (65 hours versus normal run-rate of 20-30 hours), although recovering to 38 hours in June 2020.

Rail share rose from 15 to 25%; E-way bill & diesel sale recovers

The market share of rail rose sharply over the five months ended June 2020 to around 25 percent (normal run-rate of about 15 percent) due to the shortage of truck drivers and a significant reduction in railway haulage time as passenger trains were not running. However, two indicators for road volumes – e-way bill collection and diesel consumption – have already recovered to about 85 percent of their normal levels, indicating that rail may have already conceded its market share gains to the road in the last two months.

Freight differential between rail and road remained stable with rail freight rates stable at Rs 1.8/tonne/km, while road freight rates remained elevated at Rs 2.6/tonne/km. Standalone truck operators are likely to remain under pressure, given that diesel prices have risen by about 27 percent in the last two months, while freight rates have remained stable.

Airfreight: the most affected

Passenger traffic nearly remained nil in April-May 2020 due to the nation-wide lockdown and travel restrictions. The plant load factor of 57 -68 percent reported by certain domestic carriers may not be truly representative of the actual recovery as several aircraft are still grounded. The actual volume of passenger traffic is still negligible compared to normal traffic. Freight traffic also remained muted at around 15 percent of the normal air freight volumes in May 2020, impacted by the overall weakness in economic activity, lack of manpower, and significant erosion in overall available belly-load freight capacity with many passenger aircraft grounded.