How is the Russia-Ukraine conflict affecting China-Europe trade?

Air freight has been limited, and maritime freight has become too dangerous. So, why is this upsetting the China-Europe trade?

The Russian invasion of Ukraine is raising logistical challenges between China and Europe. Global transportation is already hampered as a result of the Covid virus, and the #Russia-Ukraine conflict might aggravate the situation.

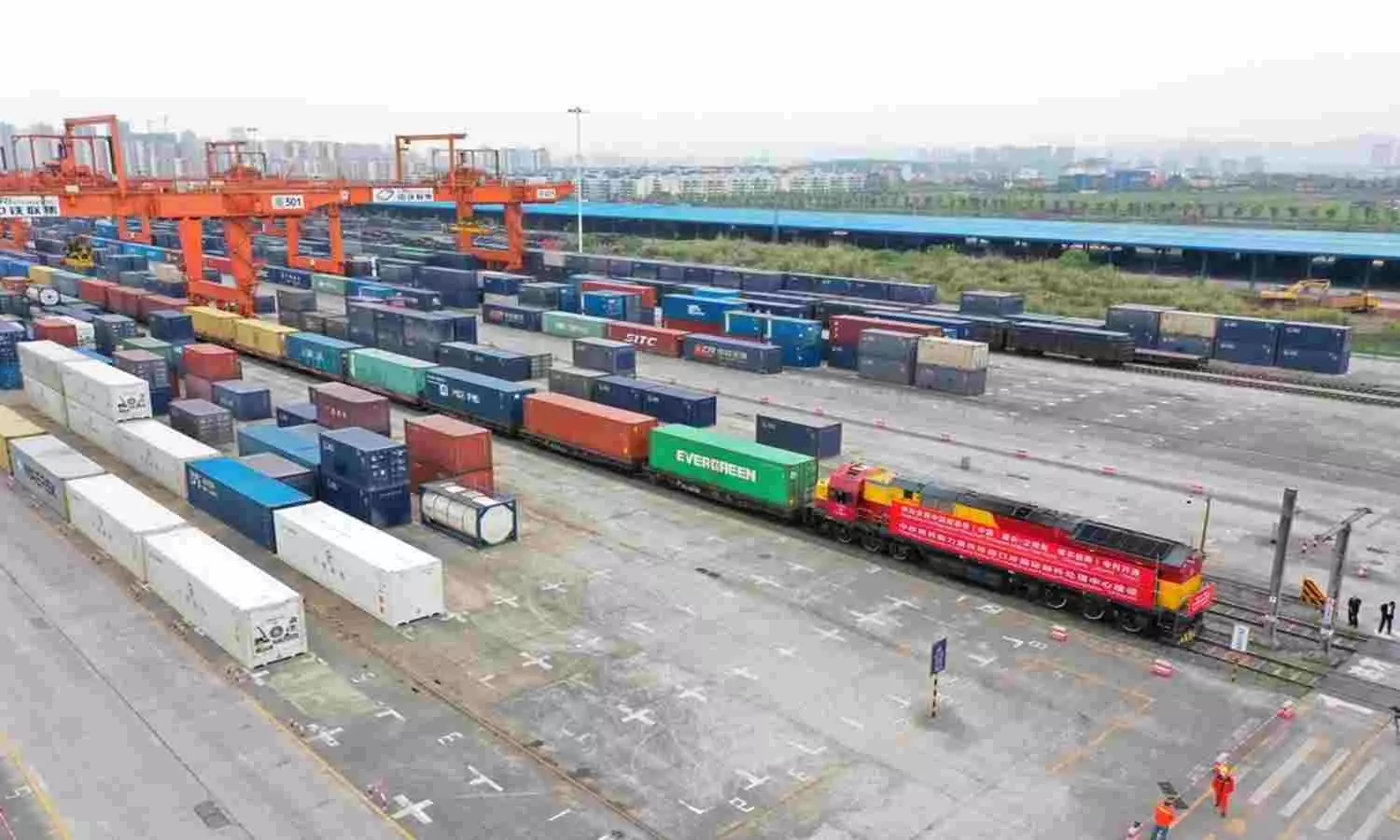

Rail freight transit, in addition to air and sea freight, is becoming an increasingly appealing mode of transport between China and Europe as rail freight transit is more efficient than marine freight and less expensive than air freight.

Backed by Chinese government investments, rail freight transit, allows commodities from northern and central China to be delivered straight to various nations in Europe, in some cases with the last-mile delivery handled by truck or short marine routes.

Andre Wheeler, China / Asia geopolitics and socioeconomics author and a specialist commentator tells The STAT Trade Times on China's position in the Russia-Ukraine crisis.

"Rail is an important trade corridor for China, with Ukraine being a significant signatory to the Belt and Road Initiative (BRI). The conflict will disrupt trade, but other BRI participants will be watching China with a keen interest as it will demonstrate the true extent of China's win-win philosophy and commitment, raising the question of whether China is in this only for itself".

Air freight has been limited, and maritime freight has become too dangerous. So, why is this upsetting the China-Europe trade?

China – Europe rail freight now

After Russia's invasion in Ukraine, some rail freight industry players have declared either commencement of rerouting for on-going transit or temporary suspension of operations between China and Europe until further notice.

Ryan Petersen, Founder and CEO, Flexport stated that the company will no longer accept Trans-Siberian rail reservations between China and Europe. Trans-Siberian train freight routes from Asia travel via Russia, merge at the borders of Belarus and Poland, and then reach Central and Western Europe.

"Flexport has ceased accepting bookings on our China to Europe Trans-Siberian railroad service effective immediately. All containers en route will be delivered. As of now the railroad is functioning normally, but customers with containers currently on the rail will be notified immediately if that changes.

"We thank our many customers who used this service over the years as a cheaper alternative to air freight and a faster alternative to ocean freight. Those customers will be presented with both of those options going forward," said Peterson on his LinkedIn post.

DSV Global Transport and Logistics announced the re-routing of cargo trains from Asia to Europe. The world knows that Russia and China have a healthy relationship since the late 1950s. China remains Russia's top supplier of imports, with mobile phones, computers, telecommunications gear, toys, textiles, clothing and electronic parts among top categories.

Ukraine on the China-Europe trade route

Ukraine was one of the earliest signatories to China's The Belt and Road Initiative (BRI), providing an important economic and trade corridor for China–EU trade. BRI is a worldwide infrastructure development project established by the Chinese government in 2013 to invest in approximately 70 countries and international organisations.

It is regarded as the core of Chinese President Xi Jinping's foreign strategy. Ports, skyscrapers, railroads, highways, bridges, airports, dams, coal-fired power plants, and railroad tunnels are among the infrastructure developments made by the Belt and Road Initiative.

Almost 80 percent of China's trade with the EU passes through Ukrainian territory. "China currently relies on the EU for 10 percent of its export volume compared to 4 per cent with Russia," says Wheeler.

"Notably, China imports 22.4 percent of its volume from the EU. This would weaken China's recovery and would reduce China's recovery rate to well below the already lower estimate of 4 per cent GDP growth."

During the last few years, Ukraine has endeavoured to re-establish its place on the New Silk Road. According to Rail Freight, RZD Logistics stated that transit via Ukraine accounted for 2 per cent of the New Silk Road's westbound container traffic volumes in 2021. This figure has risen since 2021, demonstrating the country's rising prominence.

Furthermore, Chinese President Xi Jinping emphasised the importance of Ukraine for China's BRI in January 2022. In a letter to Volodymyr Zelenskyy, Ukraine's President, he emphasised the importance of the 'growth of the China-Ukraine strategic cooperation' and the Silk Road. With the outbreak of conflict between Russia and Ukraine, the situation has been flipped, resulting in a new status quo.

Russia and Ukraine EXIM

Russia and Ukraine are the world's largest producers of metals such as nickel, copper, and iron. They are also heavily involved in the export and production of other critical raw minerals such as neon, palladium, and platinum.

The fear of penalties on Russia has pushed up the price of these metals. Palladium, for example, has a current selling price of about $2,700 per ounce, up more than 80 per cent since mid-December.

Palladium is utilised in a variety of applications ranging from vehicle exhaust systems to mobile phones to dentistry fillings. Nickel and copper costs, which are utilised in manufacturing and construction, have also been rising. The aircraft sectors of the United States, Europe, and the United Kingdom all rely on Russian titanium supply.

Since 2011, frequent rail freight ties have been developed between China and Europe. While rail only transports a small part of overall freight between Asia and Europe, it has been vital during recent transportation bottlenecks and is slowly rising. Trains are being redirected away from Ukraine, and rail freight specialists are hopeful that delays will be kept to a minimum.

Sanctions on Russia are expected to have a significant impact on rail traffic in countries such as Lithuania. Even before the invasion, ship owners began to avoid Black Sea commerce routes, and insurance companies requested advance notice of any such excursions.

Although container shipping on the Black Sea is a relatively small business on a worldwide basis, Odessa has one of the major container facilities. If Russian forces cut this off, the impact on Ukrainian imports and exports might be significant, with possibly dire humanitarian repercussions. Rising oil costs as a result of the war are a source of concern for shipping in general.

Zinal Dedhia

Zinal Dedhia is the STAT Media Group's Principal Correspondent and a journalism graduate of Nottingham Trent University, UK. She has worked with Radioandmusic.com, ByteDance, and That's TV. Zinal is passionate about air cargo, aviation, and cargo drones. Her email address is zinal@statmediagroup.com.