PrimaDollar launches supply chain trade finance in India; aims to save $50 mn for importers

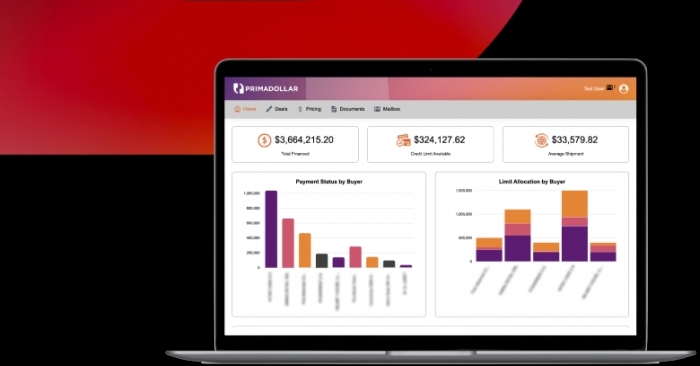

December 16 2020: Following its launch in the UK, PrimaDollar is bringing its supply chain trade finance platform to India. Supply chain trade finance is a different way for large corporates to manage how international suppliers are funded and paid.

December 16 2020: Following its launch in the UK, PrimaDollar is bringing its supply chain trade finance platform to India. Supply chain trade finance is a different way for large corporates to manage how international suppliers are funded and paid.

“Replacing LCs and other bank trade finance instruments, it delivers immediate cost savings, reduces street prices for goods, and improves India’s international competitiveness. With the top 100 Indian importers bringing in over $30 billion in goods every year, PrimaDollar is targeting savings for this sector of at least $50 million, says the release.

PrimaDollar’s platform can help Indian companies to compete both locally and internationally by reducing the input cost of materials and components required in the development and manufacture of goods for sale.

PrimaDollar is a UK-headquartered fintech providing trade finance on a global basis with clients now in more than 40 countries. PrimaDollar launched in India in September 2019 and has 5 offices and more staff in India than any other country – supporting larger Indian importers and exporters with supply chain trade finance across its digital platform.

Swati Babel, CEO PrimaDollar India, said, “It has been a lot of work to adjust our successful supply chain trade finance platform to fit with Indian market requirements. But now this has been done, with the excellent support of the leading corporate law firm, Indian companies and their Indian relationship lenders can now take advantage of this leading trade finance technology.”

PrimaDollar’s platform can help Indian companies to compete both locally and internationally by reducing the input cost of materials and components required in the development and manufacture of goods for sale.

After its launch in the UK and European markets, PrimaDollar has adjusted the platform to fit with Indian regulations, the customs, practices and norms of the Indian banks, and the Indian foreign exchange control regime.

The supply chain trade finance platform connects importers, exporters, local banks, logistics providers and funders together. The entire international supply chain is then being managed, funded and controlled by the importer through one process, irrespective of how the goods are being moved and where they are coming from. This allows whole import supply chain to move onto standard open account terms, whilst Indian banks or international partners provide funding to ensure that exporters are paid at shipment whilst importers pay later.