Biden asks ocean carriers to present "fair offer," backs port workers

"Now is not the time for carriers to refuse to negotiate a fair wage for workers while raking in record profits."

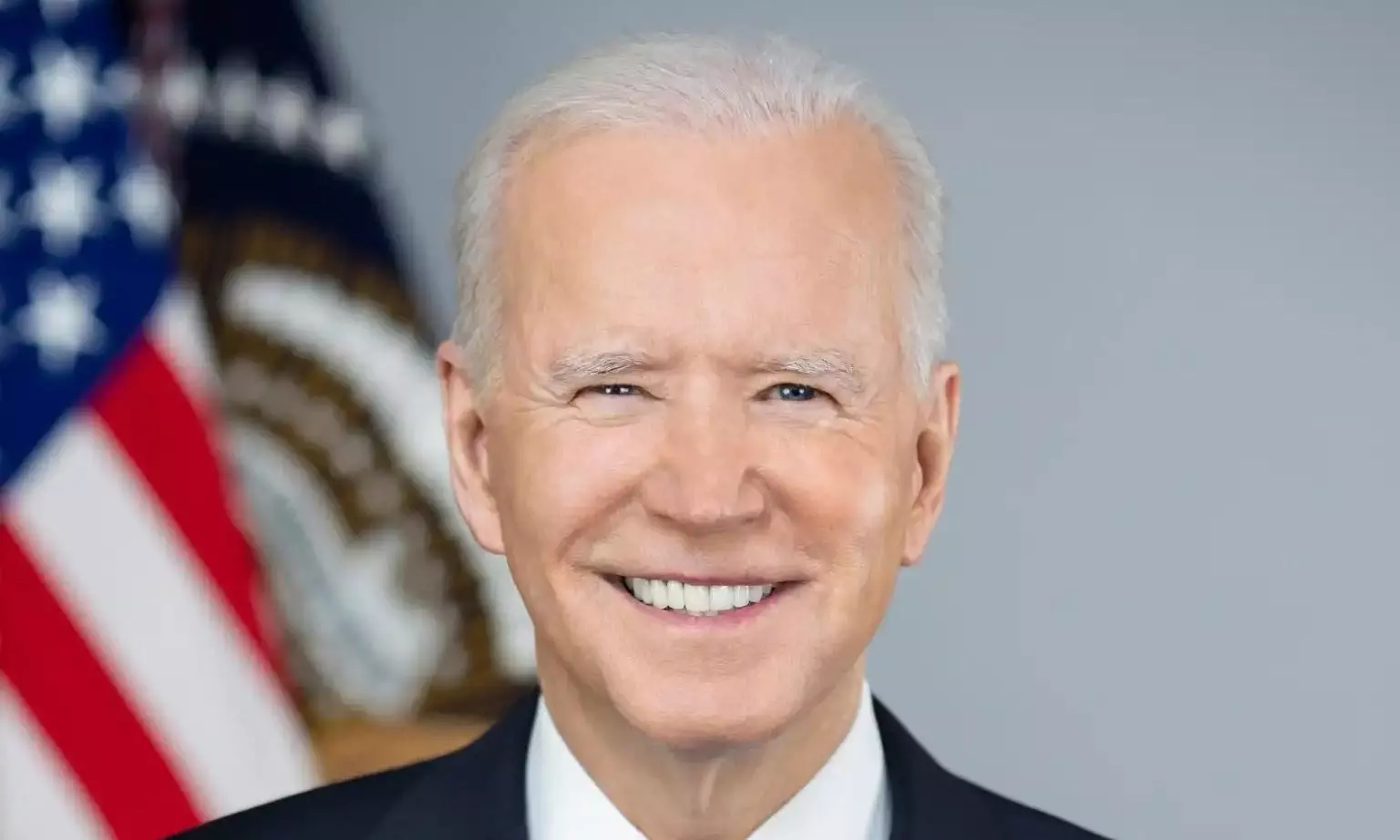

U.S. President Joe Biden has asked USMX, "which represents a group of foreign-owned carriers, to come to the table and present a fair offer to the workers of the International Longshoremen’s Association that ensures they are paid appropriately in line with their invaluable contributions."

Collective bargaining is the best way for workers to get the pay and benefits they deserve, Biden added in a statement released on October 1, 2024 after 45,000 workers across the U.S. East Coast ports went on strike demanding better wages and preventing automation of processes.

Biden said: "Ocean carriers have made record profits since the pandemic and in some cases profits grew in excess of 800 percent compared to their profits prior to the pandemic. Executive compensation has grown in line with those profits and profits have been returned to shareholders at record rates. It’s only fair that workers, who put themselves at risk during the pandemic to keep ports open, see a meaningful increase in their wages as well.

"As our nation climbs out of the aftermath of Hurricane Helene, dockworkers will play an essential role in getting communities the resources they need. Now is not the time for ocean carriers to refuse to negotiate a fair wage for these essential workers while raking in record profits. My administration will be monitoring any price gouging activity that benefits foreign ocean carriers, including those on the USMX board.

"It is time for USMX to negotiate a fair contract with the longshoremen that reflects the substantial contribution they’ve been making to our economic comeback."

USMX had offered a 50 percent increase in wages over six years in a last-ditch effort to avoid the strike but ILA leadership refused to accept the offer, leading to the stand off.

White House press secretary Karine Jean-Pierre reiterated that the administration will be "monitoring for any price gouging activity that benefits foreign ocean carriers, including those on the USMX board as well. It is time for USMX to negotiate a fair contract with the longshoremen that reflects the substantial contribution they’ve been making to our economic comeback."

The ILA is seeking a $5-an-hour pay raise for each year of the new six-year contract, which would amount to a 77 percent pay increase over the new contract’s duration, Flexport said in its latest update. "Under the previous contract, which expired on September 30, members earned up to $39 per hour, or approximately $81,000 annually. In addition to the wage increase, the union is firm in its opposition to automation."

The ILA, while confirming the strike, had claimed ocean container carriers are now charging $30,000 per container in a "whopping increase from $6,000 just a few weeks ago."

Xeneta data – which is based on more than 450 million crowdsourced data points – shows the ILA claim is misleading. "Average spot rates on the major fronthaul from the Far East to the U.S. East Coast stand at around $7,000 per FEU (40ft container) on October 1. While average spot rates from North Europe to the U.S. East Coast have increased 50 percent since the end of August, they are still only $2,800 per FEU."

Peter Sand, Chief Analyst, Xeneta says: “The union is representing its members and clearly has grievances to raise, but muddying the waters with misinformation does nothing to help resolve the situation.

“More than 40 percent of containerised goods enter the U.S. through the East and Gulf Coast, so this strike will cause carnage across supply chains and damage the US economy. Now is the time for cool heads and diplomacy rather than scaremongering and fake news.”

More context: "The all-time record average spot rate on the trade from North Europe to the U.S. East Coast was set during the Covid-19 period in May 2022 at $8,790 per FEU."

Sand adds: “It cannot be ruled out that one desperate shipper has paid $30,000 in a very extreme example, but this freight rate is certainly not representative of the market.

“The longer the strike action goes on and the longer it takes the U.S. Government to intervene, the deeper the damage will be to the economy and longer it will take for ocean supply chains to recover.”

Capacity starts getting held up

A total of 202 vessels are currently in port, waiting or expected to arrive into strike-hit ports in the next seven days, according to the latest update by eeSea.

"Total of 1,045,179 TEUs of nominal capacity on those vessels, ranging from small feeders and RoRo's to 15,536 TEUs in size. We saw a number of vessels leave port during the last hours of yesterday, and even a few berthings happening this morning (presumably those vessels will not be worked). Several are caught in port, intentionally or not. A few vessels are steaming towards Canadian ports, including small Corner Brook. And one has decided to sit still in the middle of the Atlantic, presumably awaiting developments."

Christian Roeloffs, Co-Founder and CEO, Container xChange says the U.S. dockworkers' strike is a critical disruptor for global trade with a potential ripple effect on consumer goods, manufacturing and retail supply chains. "With over half of U.S. container imports moving through affected East and Gulf Coast ports, traders are already facing significant backlogs, rerouted shipments, and rising costs. The uncertainty around how long this standoff will last only compounds the challenge as every additional day threatens to tighten capacity further, driving up container prices and squeezing margins. Container traders must adapt quickly but the ripple effects on logistics, pricing, and availability will be felt across the supply chain for weeks to come.

“The timing of this strike is especially challenging as we approach peak season. While many pulled forward shipments earlier this year to mitigate risks, stockpiled inventories will only cushion businesses for so long. If the strike continues for an extended period, we could see significant strain on container availability and shipping schedules. For small and medium-sized traders, this could result in skyrocketing logistics costs and delays, making it harder to secure containers. The longer the disruption lasts, the more difficult it will be for these businesses to keep pace with market demands.”

Shifting to air cargo

Demand had already shifted somewhat to the West Coast in the last few months, and a prolonged shutdown will intensify that trend, says Judah Levine, Head of Research, Freightos. "Demand increases or actual diverted vessels to the West Coast will likely push rates up there as well despite a projected overall decrease in import container volumes to the US in October.

"The Ports of Los Angeles/Long Beach, as well as ports in the Pacific Northwest, report fluid operations and preparedness for a sudden increase in volumes. But a prolonged strike and a significant shift of demand and port calls to the West Coast could eventually overwhelm the ports and lead to congestion that would further slow down operations, tie up capacity and push rates up."

The anticipation of the strike has already pushed some shippers, especially of perishable goods, from ocean to air cargo, Levine added. "Freightos Air Index data for Latin America - N. America and N. America - Europe rates don't reflect an uptick in air cargo prices yet, though Europe - N. America rates have increased four percent to $1.73/kg since early September.

"China - N. America air rates increased nine percent last week to $5.91/kg. This climb could reflect the beginning of air peak season, with prices already above typical peak season levels from the ongoing surge of e-commerce volumes. Though hubs in China are not reporting operational slow downs yet, some congestion is forming in Singapore and Vietnam, with the Philippines experiencing severe backlogs."

Should the strike last for one week, air freight costs will likely rise in mid-October and may last until the end of November, according to Flexport. "If the strike continues into next week, then rates could continue to spike until the end of the year, with November rate levels comparable to what we saw at the peak of the pandemic."

Dan Morgan-Evans, Group Cargo Director, Air Charter Service adds: “The strike causes real headaches for shippers, particularly from Europe. Unless President Biden changes his mind and steps in, the delayed cargo and the backlog will have to be flown in. Scheduled freighters will get booked up extremely quickly, so the charter industry will need to step in to help. We are already receiving enquiries, and we expect the first few to book soon as some cargo shipments simply cannot wait. During the West Coast port strike in 2012, we saw a huge amount of charter flights to, but mainly from, Asia, both during and after, to ease the backlog.”

First published on logupdateafrica

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com