Biden signs Ocean Reform Act; WSC says invest in landside logistics

OSRA 2022 establishes additional requirements and prohibited conduct for ocean carriers.

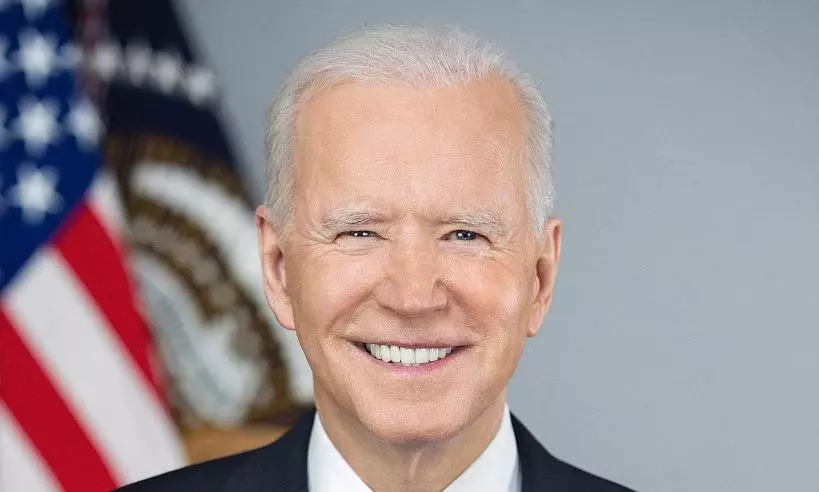

U.S. President Joe Biden signed the Ocean Shipping Reform Act of 2022 in an attempt to control increasing inflation.

Key highlights of OSRA 2022 include:

*Appropriations for the Federal Maritime Commission (FMC) for fiscal years 2022 through 2025;

*Establishes additional requirements and prohibited conduct for ocean carriers;

*Requires the FMC to issue rules related to certain fee assessments, prohibited practices, and establishment of a shipping registry; and

*Authorises the FMC under certain circumstances to issue an emergency order requiring common carriers to share information directly with shippers and rail and motor carriers.

Happening Now: President Biden signs into law S. 3580, the Ocean Shipping Reform Act of 2022. https://t.co/tI0yFPRquH

— The White House (@WhiteHouse) June 16, 2022

Fix landside problems: WSC

"Recent weeks have seen several attempts to demonise ocean carriers by deploying 'us versus them' rhetoric," says the World Shipping Council in response to Biden signing the OSRA2022. "That is not only inaccurate but dangerous, as it undermines the ability to understand and work towards solving the root causes of America's supply chain problems. Ocean carriers are the longest link in the global supply chain that delivers vital supplies to American business, government and consumers. The supply chain is not foreign; it is global.

WSC adds that "the worn-out talking point that there's only nine major ocean shipping lines who ship from Asia to the United States is also untrue. While nine lines in and of itself is evidence of competition and not concentration, there are an additional thirteen ocean liner companies that operated over 30 percent of the sailings from Asia to the U.S so far this year. In fact, competition increased during the pandemic with new shipping services entering the market and the share of the largest alliances dropping. The FMC investigation also reports that the individual ocean carriers within each alliance continue to compete on pricing and marketing independently and vigorously. Individual ocean carriers within alliances continue to add and withdraw vessels from trades both inside and outside the alliances in which they participate and, particularly in the transpacific, new entrants have been entering the trade. The transpacific is a highly contestable market.

"There is no dispute that carriers, after two decades of low or no margins and cheap and abundant capacity for shippers, are actually making profits. These profits are invested in building capacity for the future on land and sea. In 2021, carriers ordered a record-breaking 561 vessels worth $43.4 billion, and 208 vessels worth $18.4 billion have been ordered year-to-date in 2022. But as long as America's ports, railyards and warehouses remain overloaded and unable to cope with the increased trade levels, vessels will remain stuck outside ports to the detriment of importers as well as exporters. Ocean carriers continue to move record volumes of cargo for our country and have invested heavily in new capacity – America needs to make the same commitment and invest in its landside logistics infrastructure."

Record containers reach U.S

The Port of Los Angeles processed 967,900 TEUs in May, the third best overall month in its 115-year history.

The port has processed more than 4.5 million TEUs, equal to last year's record-setting pace, in the first five months of 2022.

A total of 26 containerships were backed up across LA/Long Beach ports on June 16, 2022, according to data from Captain J. Kipling (Kip) Louttit, Executive Director, Marine Exchange of Southern California & Vessel Traffic Service Los Angeles and Long Beach San Pedro, CA.

Shanghai congestion normal, rates seen going up

Congestion at Shanghai remains normal, even as much of the city reimposes lockdown, according to the latest update from VesselsValue.

"Average waiting times for containerships peaked at 69 hours at the height of the Omicron wave in late April. They have since reduced back down to last year's levels and are currently trending around 34 hours and falling."

As many as 69 percent of Xeneta customers think the backlog of volume overflowing the market (with the lifting of lockdowns in Shanghai) will increase rates. While 16 percent said there would be no change to the rate situation with this, nine percent of customers said the massive reduction in Chinese production would decrease rates.

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com