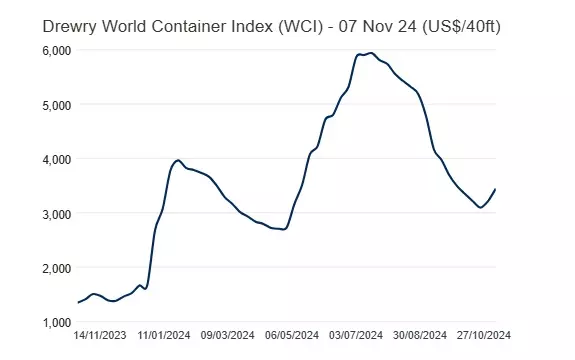

Drewry World Container Index up 7%

Freight rates from Shanghai to Genoa zoomed 21% to $4,399/FEU and from Shanghai to Rotterdam surged 16% to $3,954/FEU.

The Drewry World Container Index (WCI) increased seven percent to $3,444 per FEU for the week to November 7, which is 67% below the previous pandemic peak of $10,377 in September 2021 but 142 percent more than the average $1,420 in 2019 (pre-pandemic).

"The average YTD composite index is $4,005 per FEU, which is $1,162 higher than the 10-year average of $2,843 (inflated by the exceptional 2020-22 Covid period)," says an official release.

Freight rates from Shanghai to Genoa zoomed 21 percent to $4,399 per FEU, and those from Shanghai to Rotterdam surged 16 percent to $3,954 per FEU. Rates from New York to Rotterdam increased three percent to $785 per FEU.

"On the other hand, rates from Rotterdam to Shanghai decreased three percent to $524 per FEU while those from Rotterdam to New York fell two percent to $2,624 per FEU and those from Shanghai to Los Angeles dipped one percent to $4,806 per FEU."

Rates from Los Angeles to Shanghai and Shanghai to New York remained stable. Spot rates on the Asia-Europe trade lane increased for the second consecutive week, and Drewry is expecting this uptrend to continue next week as well, the update added.

Container volumes decline in Sept

September saw a large seasonal decline in loaded container traffic, according to new data from Container Trades Statistics (CTS), according to an update from Simon Heaney, Senior Manager, Container Research, Drewry.

"Global shipments were down 5.9 percent MoM in September to 15.2 mteu, the lowest monthly tally since April. The month is prone to seeing such declines, with volumes down on August in every year dating back to at least September 2012."

No growth in US consumer spending

The growth rate of U.S. consumer spending on both goods and services declined from a peak of 2.6 percent Y/Y in May to 1.8 percent Y/Y in September 2024.

"From a container shipping perspective, however, consumer spending on services is irrelevant. As such, Figure 1 shows the Y/Y growth in consumer spending on goods, broken down into durable and non-durable goods. The annual growth rate for both types of goods is seeing a reduction as we exit summer 2024 and get into autumn with both figures having dropped below one percent growth in September 2024," says the latest update from Sea-Intelligence.

Given that there has been no sudden excess uptick in recent consumer spending that would drive any discernible change in containerised container volumes means that the strong summer 2024 peak season for containerised imports from Asia was driven mainly by front-loading of cargo for later consumption, rather than an underlying increase in consumer demand, the update added.

Trump effect on freight rates

Donald Trump’s victory in the U.S. Presidential election is "a step in the wrong direction" for international trade as importers fear another spike in ocean container shipping freight rates, according to the latest update from Xeneta.

"Trump has vowed blanket tariffs of up to 20 percent on all imports into the U.S., and additional tariffs of 60-100 percent on goods from China."

Data from Xeneta shows the last time Trump ramped up tariffs on Chinese imports during the trade war in 2018, ocean container shipping freight rates spiked more than 70 percent.

First published on logupdateafrica