Festive bliss to Red Sea abyss: Unraveling of global supply chains

In the dynamic world of global logistics, this December brought an unexpected twist to the traditional narrative of stabilizing freight costs and diminishing demands. Reflecting on this anomaly, Liberty Baugher, Director of International Logistics at Sunset Transportation, noticed a delicate balance of average demand, reduced capacity, and higher rates. Baugher said, "With the supply chain returning to normal, we're facing average demand, reduced capacity, and higher rates. Despite equipment shortages, there's no dramatic spike in spot market rates as ocean lines strive for efficiency."

Baugher's insights, backed by GoComet's data, revealed a unique dynamic where demand this year fell slightly short of the previous holiday season's robustness. While businesses faced a 37% increase in freight rate requests last year, the ongoing season witnessed a more conservative 28% uptick in freight RFQs. This unexpected ebb in demand challenges the notion of a typical holiday surge, inviting a closer look at the factors steering the industry's trajectory.

The story took a dramatic turn in November with the unforeseen Red Sea Crisis where an attack by Houthi disrupted 12% of global trade, leaving 129 vessels stranded with cargo worth $16.7 billion. Resulting in a series of events - From increased carrier rates to a complete halt by some carriers with a long detour around the Cape of good hope added as a safety measure. Businesses across the globe now are bracing for longer transit times, higher shipping costs, and potential shortages of essential goods, reminding us of the interconnectedness of our world and the fragility of critical trade arteries like the Suez Canal.

Navigating the ramifications: Rerouting and bottlenecks

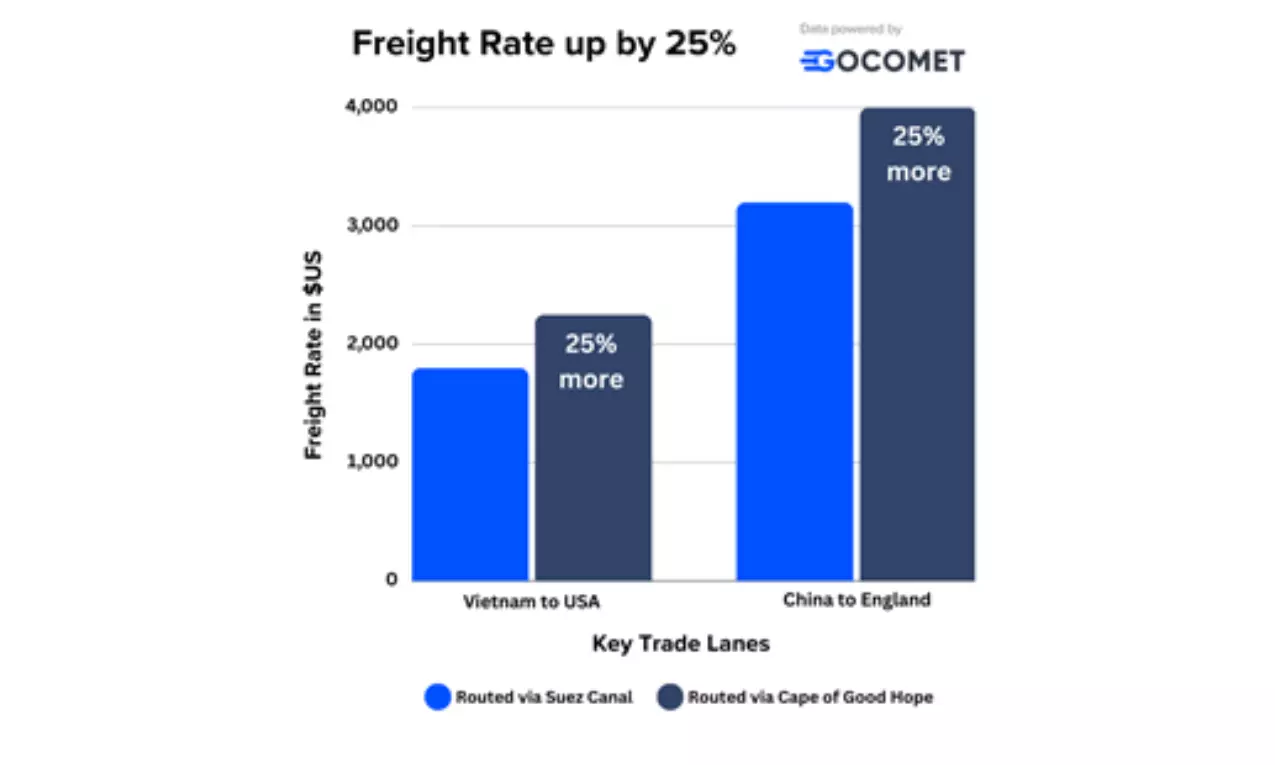

High risks of an attack have forced companies to reroute vessels via the lengthier Cape of Hope to provide a safe passage to the ships adding to hefty cost increases to their journeys. As of December 19, 2023, Freight rates on East-West routes had surged by 25%, adding a staggering $31 billion to the annual shipping. This is due to increased fuel costs and other costs associated with the rerouting, adding further pressure to already squeezed profit margins.

The consequences of this rerouting extend far beyond costs. Production schedules are thrown into disarray, with just-in-time manufacturing facing agonizing wait times. Inventory shortages loom, potentially leading to temporary disruptions in essential goods like electronics and consumer products. This unfortunate domino effect has resulted in a brutal double whammy for both businesses and consumers: freight costs have risen by 25-30%, while transit times have stretched by two to three weeks (14-21 days).

Ultimately, these economic ripples reach the shores of consumer wallets. The additional costs incurred by businesses are likely to be passed on, potentially leading to price hikes for everyday goods. The Red Sea crisis serves as a stark reminder of the interconnectedness of the global economy, where disruptions in one corner can create tremors across continents and impact the lives of consumers worldwide.

In the face of such unprecedented challenges, true resilience comes when businesses are prepared to make pivots on-the-go with strategic use of data becoming paramount.