Tariffs, temptation, and test of time: If only supply chain realignments were so easy?

With a fresh wave of tariffs against all trading partners, the protectionist playbook returns—bold on headlines, thin on long-term vision. As we saw during COVID-era disruptions, the real lesson is that systemic change requires patience, not punitive economics.

Back in my May 2020 opinion piece for this very publication, I had highlighted how the COVID-19 pandemic exposed deep strategic cracks in global supply chains. The sudden halt in movement laid bare the world’s overdependence on China, sparking widespread calls for decoupling—and giving a boost to alternative operating structure. Now, in a very different context but with eerily familiar undertones, we are once again bracing for another global trade shake-up, this time driven by sweeping tariffs and rising protectionist sentiment.

World trade today is far more intricate and interdependent than it was even two decades ago, shaped by layered value chains and cross-border production networks.

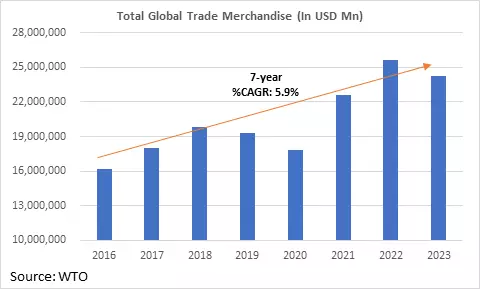

The inclusion of China into the WTO in 2001 was a pivotal moment, unleashing a wave of global manufacturing realignment. Western consumer economies rapidly outsourced production to China and other low-cost Asian hubs, optimizing for scale, efficiency, and price. This led to the rise of globally fragmented supply chains, where a single fast-fashion apparel item might be designed in Milan, stitched in Bangladesh using fabric from China, finished in Vietnam, and sold in a boutique in New York City. The result was cheaper goods for consumers—but also a deepening reliance on a globally synchronized system. More recently, WTO data shows that total global trade in merchandise has grown at a healthy 7-year CAGR of 5.9%, despite major disruptions like the COVID-19 pandemic. After a dip in 2020, trade volumes rebounded strongly, underlining the resilience and continued integration of global supply chains.

In truth, the great irony of this moment is that protectionism from the world’s largest economy risks undermining the very system that has powered decades of shared global prosperity. Let’s break this down with a few telling examples that show why walls don’t build economic strength—supply chains do. Let’s call this the ABCs of global trade.

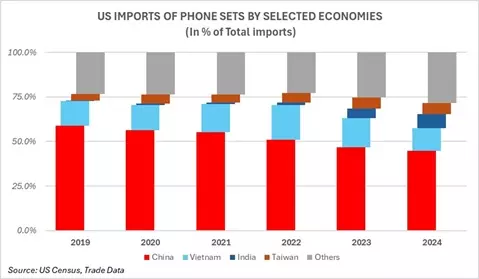

Apple Inc.—the crown jewel of American brands. In 2017, China accounted for over 64% of U.S. phone imports—driven in large part by Apple’s massive supply chain footprint. However, the company has visibly realigned its supply chain over recent years following COVID disruptions. And due to this China’s share in US Phone Imports has steadily declined to just under 45% in 2024. With Apple setting up a large manufacturing base in Vietnam, the country’s share grew from under 5% in 2017 to a peak of nearly 20% in recent years. Likewise, India’s share of U.S. phone imports—nearly negligible in 2017—has climbed to almost 8%, reflecting Apple’s growing shift in manufacturing beyond China. This shift illustrates that while supply chain diversification can happen, it’s a gradual and strategic transition which took almost five years—not something that can be forced abruptly through tariffs.

BMW stands as Germany’s crown jewel in automotive engineering. Now consider the case of BMW that has embraced the U.S. as a key manufacturing base. The company’s Spartanburg, SC (USA) plant is now BMW’s largest globally, churning out over 1,500 vehicles a day and the plant has shipped more than $100 billion in export value in the last decade. (Source: Company reports). In fact, this has made BMW the top automotive exporter from the United States by value and the largest employer in the state. Yet, despite this win-win setup, BMW is caught in the crosshairs of the proposed tariff policy: the company would have to pay duties on importing essential auto parts into the U.S. for the plant and faces potential EU retaliation when shipping the finished cars from the plant back into Europe. In effect, BMW is penalized both for creating U.S. jobs and for being globally competitive. This tangled outcome reflects the unintended consequences of protectionist policies—where the costs often boomerang back to the very economies they aim to shield.

California ports of LA and Long Beach - No entry point matters more to America’s trade than this infrastructure. However, sudden protectionist moves can unsettle well-set logistics ecosystems. In anticipation of new tariffs, import volumes at the ports surged to record highs. But once the shockwaves hit, no one stands to feel the impact more than these frontlines of America’s trade with the world. Shipping lines have noted that such volatility often triggers a short-term spike in costly air freight as companies rush to beat tariff deadlines, followed by a lull in ocean shipments. Faced with abrupt policy changes, manufacturers and retailers grow wary, trimming inventory levels and shifting demand unpredictably across sea and air. This whiplash in freight patterns undermines long-term planning, port efficiency, and container availability at ports of LA/LB. While diversification of supply chains is a natural evolution, politically triggered tariffs force this transition chaotically rather than strategically.

So where does this leave India? This disruption is less a threat and more a timely opening to find our footing in global trade. As supply chains rewire, India has the chance to position itself not as a replacement, but as a reliable partner in the next phase of globalization. But that path demands collaboration, clarity, and consistency.

While global trade is currently being blamed for fueling inequality, it has actually enabled billions economically—creating new consumer markets, stabilizing regions, and fostering innovation across borders. This convergence has been made possible only through openness and integration—not isolation. If there’s one thing history has shown, it’s that no tariff can ‘trump’ the long-term gains of a truly connected global economy.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Indian Transport & Logistics News.

Vikas Pawar

Vikas Pawar is a regular contributor and a supply chain specialist with deep experience in global trade and logistics strategy. Currently, he brings this perspective into the healthcare space as COO of Exsegen Genomics, a cancer-research company.