Warehousing in 8 Indian cities to grow at 19% CAGR till FY2026: Knight Frank

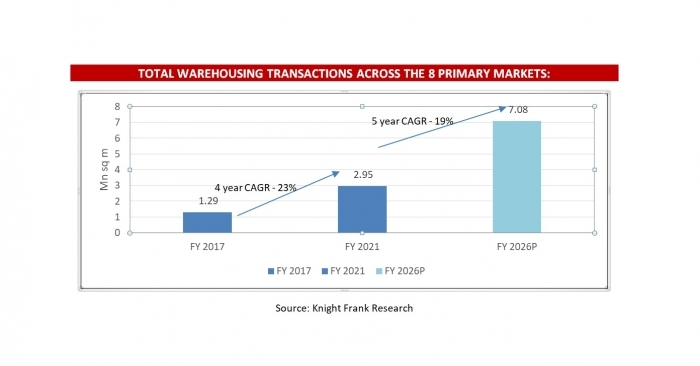

July 9, 2021: The international property consultancy, Knight Frank India, in their latest report - India Warehousing Market Report – 2021, projects that annual warehousing transactions for top eight Indian cities (primary markets) will grow at a compound annual growth rate (CAGR) of 19 percent to 76.2 mn sq ft (7.08 mn sq m) by financial year (FY)

July 9, 2021: The international property consultancy, Knight Frank India, in their latest report - India Warehousing Market Report – 2021, projects that annual warehousing transactions for the top eight Indian cities (primary markets) will grow at a compound annual growth rate (CAGR) of 19 percent to 76.2 mn sq ft (7.08 mn sq m) by financial year (FY) 2026 from 31.7 million sq ft (2.95 million sq m) in FY 2021.

As per the projections for the next 5 years (FY 2022 – FY 2026), the e-commerce segment is expected to take up significant space estimated to be 98 mn sq ft (9.1 mn sq m) approximately registering an increase of 165 percent from the preceding period of FY 2017 – 2021. Third Party Logistics (3PL) and other sector companies are expected to take up 56 percent (83 mn sq ft) and 43 percent (53 mn sq ft) more space respectively, over the same reference period.

With respect to total land committed to the warehousing development in the top 8 cities is approximately 22,488 acres, which will translate to a total buildable potential of up to 531 mn sq ft. Existing warehousing stock already accounts for 329 mn sq ft on this committed land, leaving about 202 mn sq ft of potential warehousing space that can be developed in these land parcels.

In FY 2021, the warehousing transactions in the top 8 Indian cities registered a decline of 23 percent year – on – year (YoY) to 31.7 mn sq ft. This decline can be attributed to the disruption caused by the pandemic and the associated lockdowns that brought economic activity to a near halt and adversely impacted occupier decisions. Chennai was the only city to witness a growth of 4 percent YoY to 3.5 mn sq ft in FY 2021, compared to 3.4 mn sq ft in FY 2020. While Bengaluru transaction levels remain stable, Ahmedabad and Pune were the worst-hit markets with a decline of 42 percent YoY each.

Occupiers showed a marked preference for Grade A properties as they are much better geared toward tackling exigencies such as those posed by the pandemic. Increased demand by e-commerce companies also resulted in increased preference for Grade A properties. 65 percent of all transactions during FY 2021 were in Grade A properties with the exception of Bengaluru and Ahmedabad, more than half the area transacted in all the top markets occurred in Grade A properties.

The report also evaluates 13 secondary markets. These markets show strong future potential as their current share in transactions have grown consistently from 12 percent in FY 2019 to 23 percent in FY 2021. Secondary markets accounted for 0.9 mn sq m (9.7 mn sq ft) of warehousing transactions during FY 2021.

Shishir Baijal, chairman & managing director, Knight Frank India, said, “The past five quarters have been nothing short of a roller coaster ride as successive infection waves adversely impacted human life. During this period, most commercial real estate asset classes have been impacted by the headwinds including the Indian warehousing sector. But inherent strength of the Indian economy, strong domestic consumer base and some unique opportunities arising out of the pandemic have mitigated the impact on the warehousing sector.”

Shishir further added, “Supply chain disruptions from the pandemic have intensified the need for more institutional players in the warehousing segment which will ensure institutionalisation of the warehouse space, leading to greater participation from the big developers. In the short run occupier activities will be dictated by the intensity of the pandemic however in the long -term perspective the sector should gain momentum aligning itself to India’s economy development trajectory.”

The warehousing space per capita in India is significantly lower than in developed economies. With the critical business objectives that a supply chain serves, industrial and warehousing spaces have a long runway for growth in this country. This premise also builds a pathway to progress on the maturity curve for the sector and promotes increased institutional participation.

The e-commerce sector is expected to see the maximum growth in warehousing transaction volumes among all sectors over the FY 2022-26 period, with its share of annual transactions growing from 31 percent currently to 37 percent in FY 2026. E-commerce, 3PL and Other Sectors are expected to account for 86 percent of the total warehousing transacted space in the next five years (FY 2022-26) compared to 78 percent of the transacted space during FY 2017-21.

Though, there is a YoY fall in transaction volumes in FY 2021, demand has grown at a CAGR of 23 percent in the FY 2017-21 periods.

The e-commerce sector has been reported as a major demand driver for warehousing markets all across the globe. The e-commerce market in India is still in its infancy, with market penetration at 4.7 percent (2019 est.). The growth potential for the segment has been substantial in mature markets of UK and USA. The entry of Indian business giants in the space signifies that the e-commerce segment is at the cusp of its next phase of growth.

There is a massive gap between the size of the Indian warehousing market and more mature markets of the USA, China and the United Kingdom. India has a per capita warehousing stock of just 0.02 sq m compared to the USA, China and the United Kingdom that have 4.4 sq m, 0.8 sq m and 1.09 sq m respectively.

The report highlights that the development of Grade A warehousing facilities has increased in recent years, currently constituting 35 percent of the total stock compared to 34 percent in FY 2020. Pune (71 percent) and Chennai (71 percent) have the highest concentration of Grade A stock due to their primary demand base of auto and auto ancillary occupiers. Mumbai (18 percent) and NCR (29 percent) being older markets have a significantly lower proportion of Grade A warehouses.

As per the report, warehousing demand in secondary markets has grown 31 percent YoY compared to a 23 percent YoY de-growth for primary markets, in FY 2021. The secondary markets contribute around 23 percent of overall warehousing demand in India. Among the secondary markets, Indore and Jaipur noted exponential growth of 306 percent and 219 percent respectively in FY 2021.

Rent growth faced significant headwinds in the challenging market with occupiers negotiating hard for incentives like rent-free periods and delaying contractual escalations to tide over liquidity issues.