Duration of Red Sea crisis unknown variable, says Drewry

"Suez Canal diversions will inflate shipping costs for as long as the situation lasts but trade always finds a way";

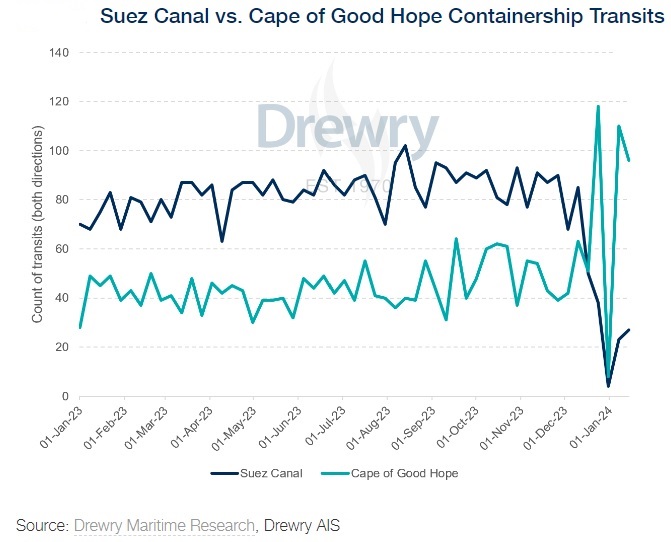

Carriers are unlikely to resume Suez Canal transits until a time when the risk of attack has been eliminated, which seems more like months than weeks away, according to the latest assessment from Drewry.

"The duration of the crisis is the key unknown variable." In the best-case scenario, if trade starts to flow through Suez again shortly, the normal market dynamic will almost immediately snap back into play and prices will ebb, as too, sadly, will public interest in this fascinating sector, the update added.

"Suez Canal diversions will inflate container shipping costs for as long as the situation lasts but trade always finds a way, even if it takes a bit longer than usual," writes Simon Heaney, Senior Manager, Container Research, Drewry.

"Two prominent risks to container shipping (and all other shipping sectors for that matter) have sadly become real, and have put shipping back into the limelight.

"The first risk emanates from geopolitical factors, exemplified by carriers deciding to avoid the Red Sea and the Suez Canal following a series of attacks on ships by Yemen’s Houthis rebels in support of Hamas in the war with Israel.

"Simultaneously, the second risk arises from the spectre of climate change, here exemplified by the Panama Canal reducing its capacity in a bid to preserve levels in the canal’s watershed.

"The realisation of these twin risks has created a metaphorical pincer move that threatens to overturn all of Drewry’s previous predictions about the container market’s direction and balance of power."

It is important to "state that neither canal is formally closed but faced with a very real physical danger to crew and assets (Suez), and capacity restrictions and potential operational delays (Panama), carriers must quickly decide if the risk is worth it, and if not, plot a new course asap."

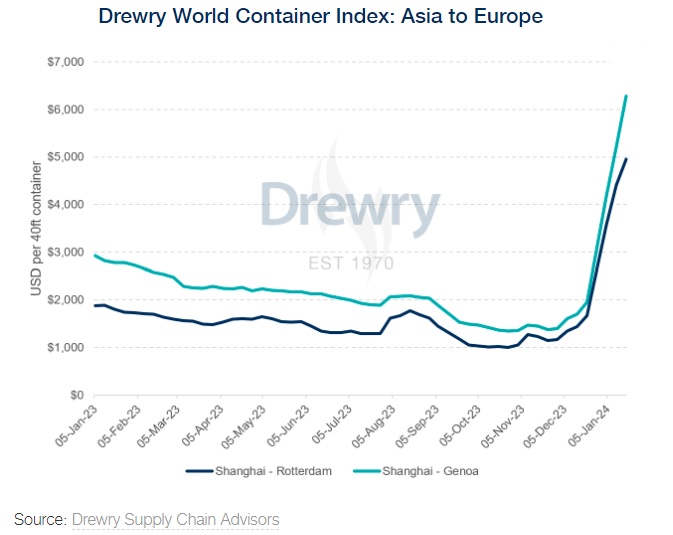

While Drewry's comparative analysis suggests that there should only be a minimal increase in round voyage costs, spot market freight rates on Asia to Europe trades have soared. "Drewry’s World Container Index (WCI) Shanghai to Rotterdam subset has increased by 246 percent (to $4,951 per 40ft container) since major carriers first announced they would divert in mid-December.

"Excluding the pandemic years 2020-22, at $3,777 per 40ft container, the composite WCI value for 18 January 2024 is the highest on record (series starting 2011)."

In the worst-case scenario, whereby Suez has to be avoided for the entirety of 2024, assuming a 30 percent increase in trade distance for the roughly 30 percent of container ship capacity that previously transited Suez, that would reduce effective capacity by some nine percent, the update added.

"That would only improve our global supply-demand index to a reading of 82, indicating a still heavily oversupplied market (anything above 100 is a tight market, anything below signifies overcapacity)."

While the situation will impact some trade more than others, on a global level, it won’t completely flip the supply and demand story, the report added.

Drewry WCI up 23%

Drewry’s World Container Index (WCI) increased 23 percent to $3,777 per 40ft container for the week to January 18, 2024, and has increased 82 percent when compared with the same week last year.

"The latest Drewry WCI composite index of $3,777 per 40ft container is the highest since October 2022 and is 166 percent more than average 2019 (pre-pandemic) rates of $1,420."

Freight rates on Rotterdam to Shanghai increased 50 percent to $975 per 40ft container, followed by rates on Shanghai to Los Angeles which rose by 38 percent to $3,860 per FEU.

Drewry is expecting East-West spot rates to increase in the coming weeks due to the Red Sea/Suez situation.